Fantom Ecosystem Spotlight – Matrix

What do the Matrix films and this week’s featured project have in common? Well, besides the name and the reference in Matrix protocol’s logo, we would say a broad interest in questions of freedom and choice.

These concepts drive the intentions of the Matrix DeFi protocol developers. Concerned about making DeFi accessible, the builders behind this slick dApp have wrapped some very sophisticated tools into an easy-to-use aggregator for novice and experienced investors alike.

Want to learn more? Take the red pill then, and keep reading.

1. What is Matrix?

We define Matrix as the simplest yield aggregator on Fantom. To start investing with Matrix, you just need Fantom tokens.

Once deposited into a pool, our Zapper smart contract automatically converts FTM into Liquidity Pool (LP) tokens and deposits them for you.

The same happens when withdrawing ‒ investors receive FTM and not LP tokens.

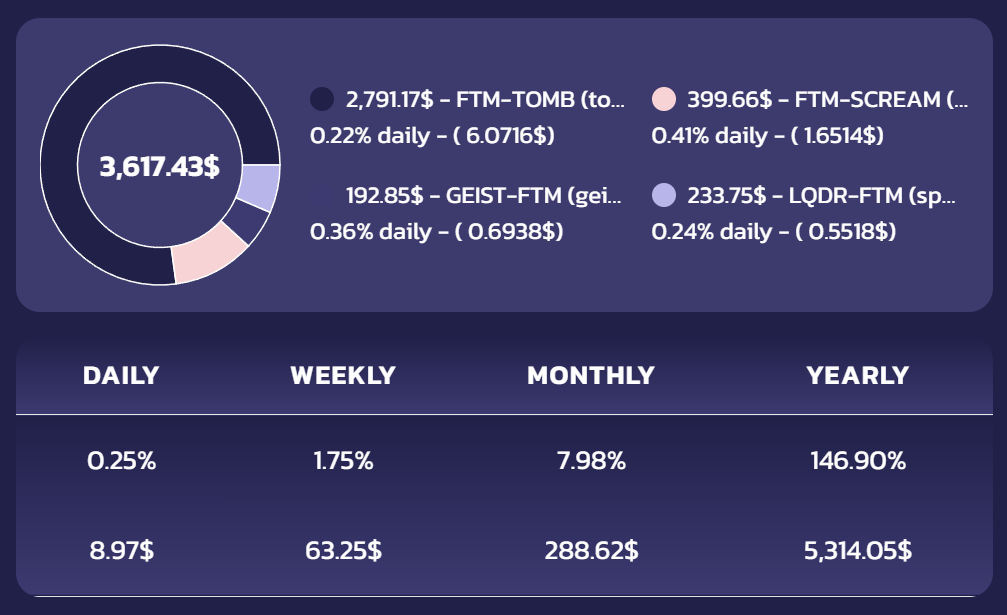

We also offer risk management and portfolio tracking tools. On the Dashboard page of the dApp, users can access:

- a visual, detailed portfolio position breakdown with estimated returns.

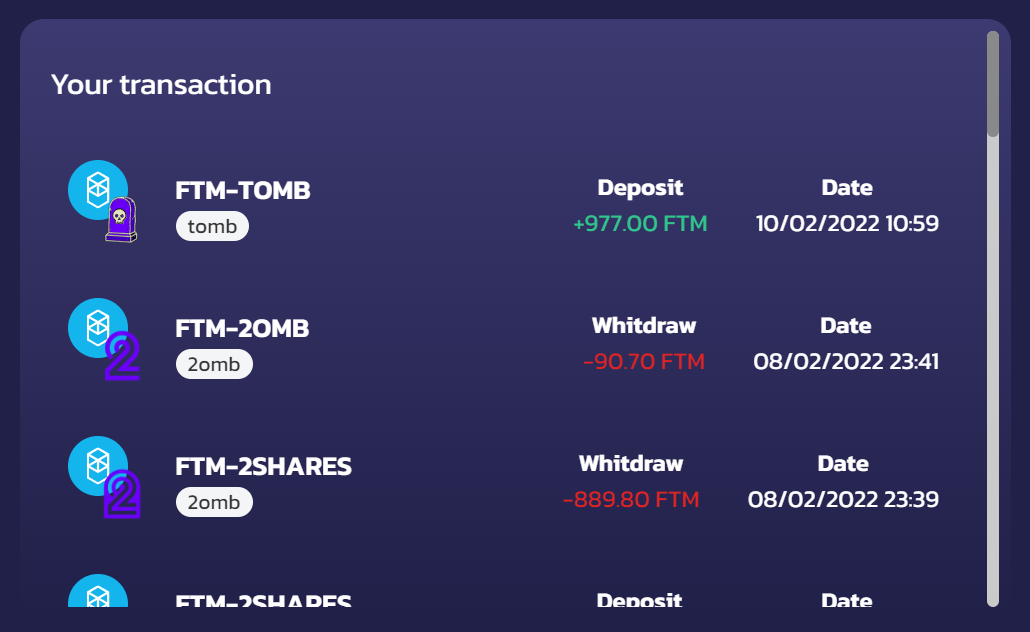

- a full history of transactions conducted on the platform.

In addition to this, when users click on the “more info” button to the right of every vault, the platform delivers estimated, trailing 14-day Impermanent Loss (IL) statistics along with the standard APR/APY and fee details.

Differently from other auto-compounders, we offer a system that optimizes compound time ‒ sometimes less than 5 minutes ‒ with gas fees.

We do this in part through a bounty system that enables users to earn rewards by effecting a single transaction to distribute rewards to all investors in a LP.

2. How do you introduce Matrix to a novice, or someone who knows little about Defi?

Matrix is built for you.

We built Matrix following our own metrics and design. Our mindset has been that Matrix should be safe enough to let our family and friends put their Fantom to work.

Matrix was born out of a desire to help people who know little about DeFi, who don’t want to create LPs, and who might not fully understand impermanent loss.

Everything you need is self-contained in the platform. Our aim is to help you grow your money and to save you time!

3. Can you give us a rundown of what Matrix offers?

Investors love Matrix for 5 main features:

Impermanent loss visualization

This gauge helps users identify pools with the highest risk of impermanent loss.

Risk assessment

Along with the impermanent loss stats, detailed vault information helps users assess the risk of a liquidity pool and identify the one that satisfies their risk appetite.

Monitoring

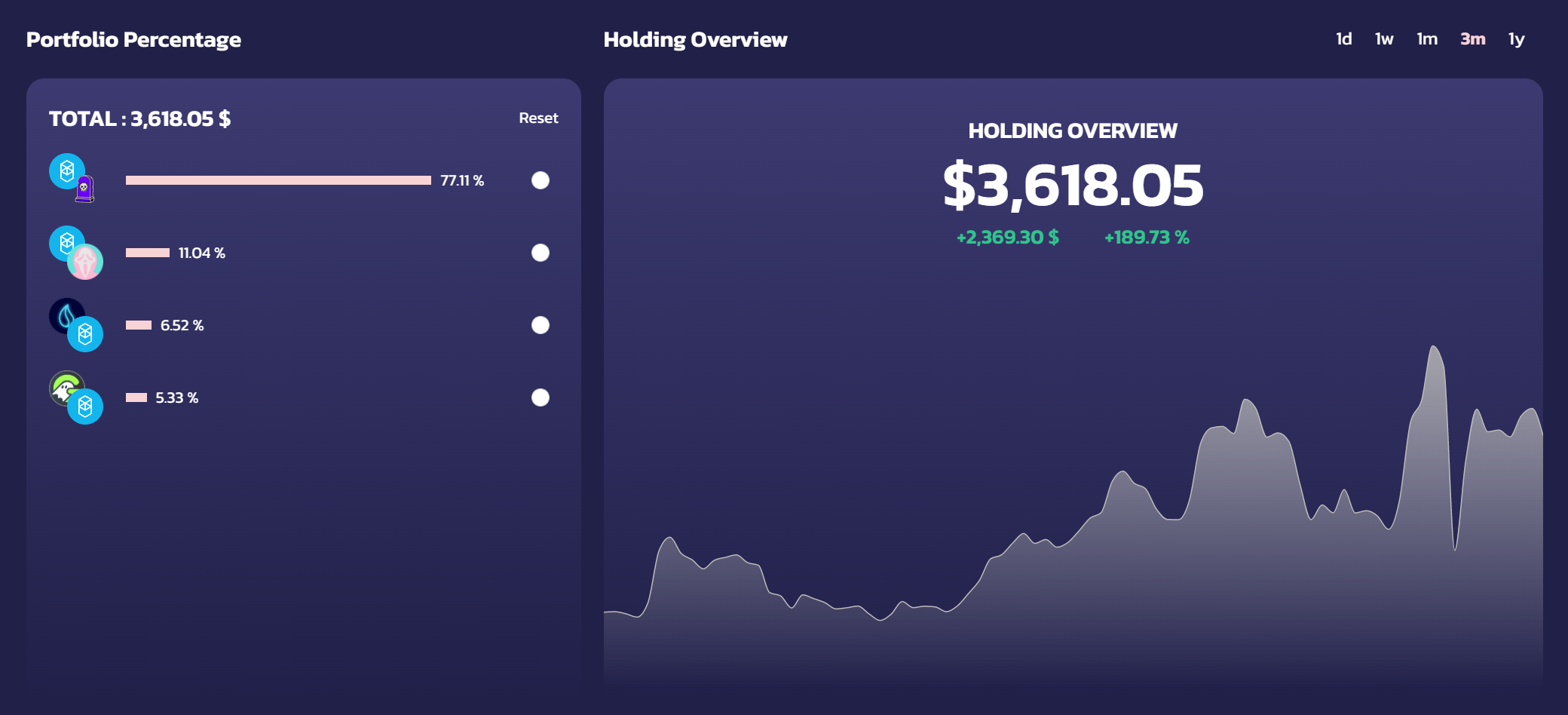

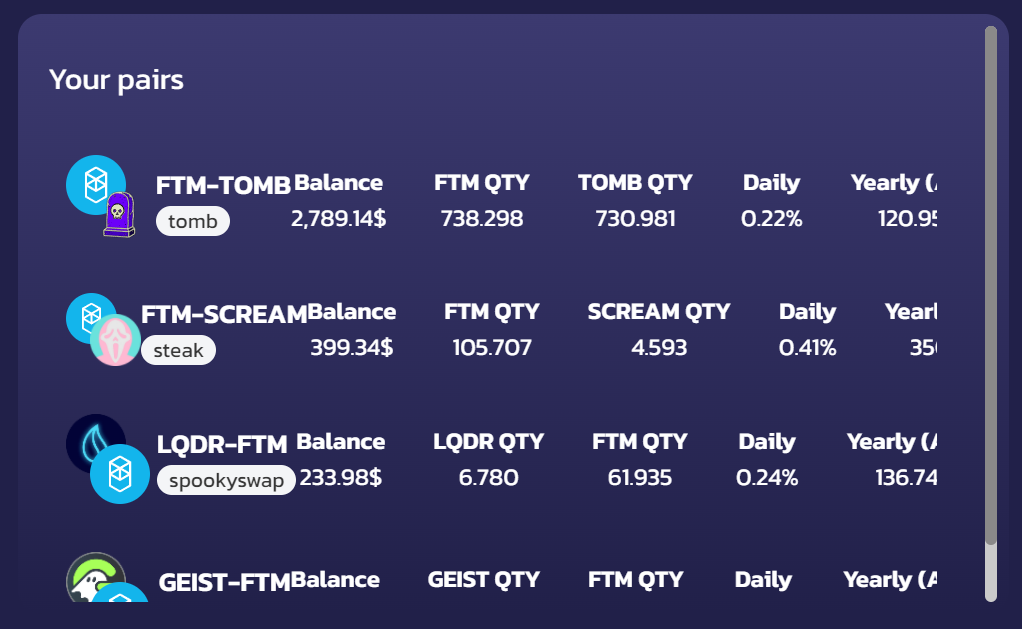

Users can graphically monitor the daily, weekly, monthly, and yearly performance of their personal portfolio, while also tracking how many LP tokens they have for each pair.

Portfolio analysis

Users can analyze the composition of their portfolio while also understanding the relative weight and performance of a single pair with respect to their overall holdings.

Historical transactions

Users can track any deposit, withdrawal, or portfolio rebalance by simply consulting the Dashboard.

4. How did you come up with Matrix and what inspired you?

As math and finance guys, we observed that we needed more data to understand how our investments were doing.

Moreover, since many of us also come from Web2 companies, we also noticed that the DeFi UI/UX experience needed to be improved. Hence, we decided to close this gap by launching Matrix.

5. What is your background?

The power of Matrix is in its team.

First and foremost, we are all great friends. We come from different backgrounds. The founders have 5+ years of experience working with large software companies and enterprises that are publicly listed.

Experience in the team includes master’s level study in engineering and finance, and job experience with leading investment banks, private equity, and hedge funds.

In short, we are a strong team with different educational backgrounds and skills, but with one purpose: making Matrix the best autocompounder on Fantom.

6. How did you learn about Fantom?

We are finance nerds who like to read and research a lot.

It just happened unexpectedly one night, when we were doing our classic Sunday due diligence.

Also, I am a fan and a follower of HyperChain Capital (and Stelian Balta) so when I saw that they started investing in Fantom, I realized it was time to learn more about it.

7. Why did you decide to build on Fantom?

We began our journey on Fantom as investors, and we have been proud members of the community for more than one year.

About 14 months ago, after realizing how much potential and power there is in Fantom and the ecosystem, we decided to build on it.

Another reason is that, as investors, we tried all of the DeFi platforms on Fantom ‒ there are many more now than back then ‒ and we all agreed that something was missing.

We needed a platform able to give us risk metrics, portfolio analysis data, and a clearer and faster UI/UX experience.

That was missing on Fantom and now Matrix is closing this gap.

8. What has your experience been like, building on Fantom?

In five words: Fantom has the best community.

From the start, we have always received support from leaders in the Fantom community like Simone Pomposi and Austin, from FTM Alerts – so here’s a big shout-out to them.

Our users have always been supportive of what we were building and, for that reason, we have decided to reward them with a juicy airdrop when the token launches (alpha leaked here!).

9. What brings you to DeFi and what excites you most about the space?

I think it is safe to say that DeFi will be one of the major trends for the next few years.

Hence, it would be insane for a tech-passionate team like the Matrix one not to build in this sector.

Innovation is what excites us, and we have many more ideas for Matrix that we’ll be implementing, one step at a time.

10. How did the community receive Matrix? What should we know about your community?

The Fantom community really supported us from the start.

Especially nowadays, I have noticed that whoever tries Matrix really remains impressed by the innovation that we have brought into the community.

We do not have a Discord yet, but we encourage everyone reading this to enter into our Telegram for all the latest news.

11. What’s coming up for Matrix? Free alpha!

I guess readers will love to read this and actually, I am excited to say that we are working on our token.

It will be a token that will provide real value for the users and truly make them feel part of Matrix.

One of the main benefits of the token will be the opportunity it gives to holders to receive platform fees.

Moreover, we are also having discussions with big partners, and we are also exploring partnering with a Metaverse project.

Looking forward, what we really want for Matrix is to become the Robinhood of DeFi.

12. What would you like to say to fellow developers who haven’t yet started building on Fantom? What resources can you recommend to someone starting out on Fantom?

This is the time to start.

The community is awesome and supportive, and you’ll always find the help you need.

Just to give you a real-life example, a friend of mine was inspired by what we’re doing on Matrix. He has started his own project, called Scary Chain Capital, and is having a wonderful experience.

Speaking about resources, I believe that it is important to follow the Fantom Foundation and the FTM Alerts socials, and if you like technical analysis, I suggest you give a follow to Tweak986. But there are a lot of interesting Twitter accounts like Fantom Hub, Fantom Daily, Fantom Space, and more that are worth following.

13. Is there anything else that you would like to add?

We receive many questions about what a “Bounty” is.

The Bounty function is basically a way for users to get an extra return. We are an auto compounder, but we give the opportunity to users to call the harvest function and receive part of our fees (the Bounty).

Our users really like it, and some have already set up scripts so that whenever the Bounty is higher than the gas fees for calling the harvest function, they call it.

This system benefits the users since the compound interval is usually very low, sometimes even lower than 5 minutes, and it also reduces the gas fees for calling the function. So in the end, everyone gains.

Engage with Matrix: