How to Stake and Delegate on Fantom

Staking is a vital part of securing the Fantom network through proof-of-stake. Validator nodes must stake FTM tokens, which incentivizes them to act honestly in block production as they risk losing their stake otherwise.

However, FTM holders are also able to participate by staking their FTM and delegating it to an existing node to earn rewards. Fantom offers several staking benefits as it has no minimum stake, no mandatory lock-up period, and offers liquid staking services!

Let’s explore how to stake on Fantom and how to delegate your stake.

— Why stake on Fantom?

— How to stake on Fantom?

— Liquid staking on Fantom

— Frequently asked questions

Why stake on Fantom?

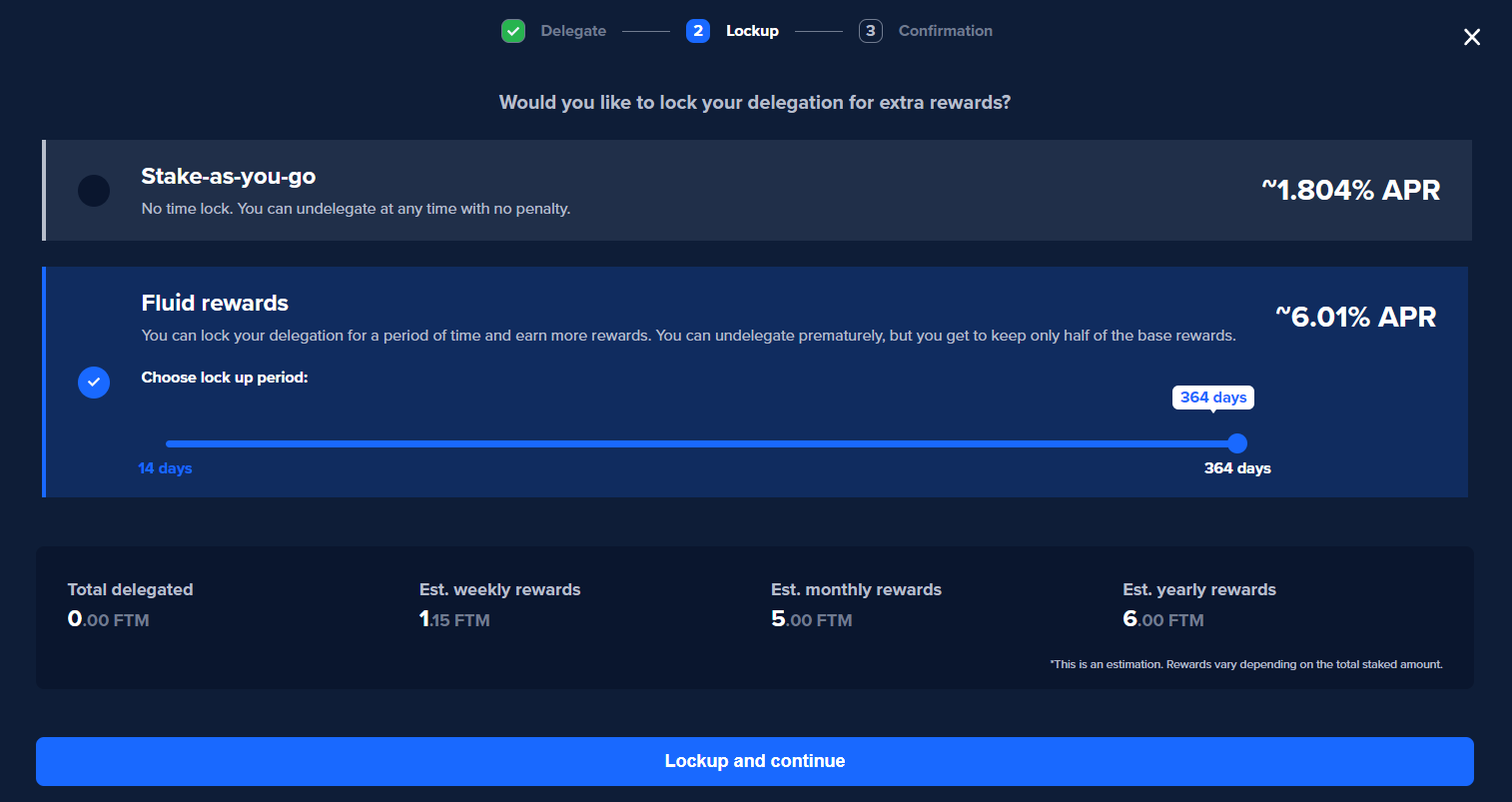

Since staking helps to secure the Fantom network, you receive rewards in the form of APR (annual percentage rate). The current APR for staking on Fantom starts at 1.8% and increases gradually to 6% depending on the optional lock-up period that you choose, which ranges from 0 to 365 days.

For example, if you stake and lock 100,000 FTM for 365 days, you’ll have 106,000 FTM by year’s end. You can estimate your staking rewards on the Fantom website.

Furthermore, by staking FTM, you receive access to submit and vote on governance proposals to shape and influence Fantom’s future.

How to stake on Fantom?

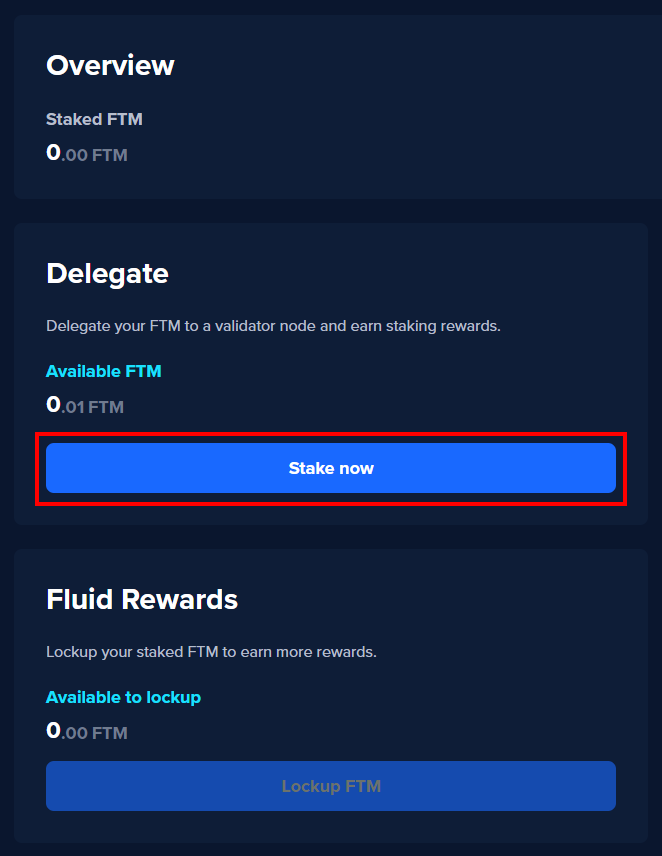

To stake FTM on Fantom, open the Fantom fWallet, connect with your wallet, and head to the Staking section. Fill in how many FTM to stake and choose a node; this is the node to which you’re delegating your stake and each offers various max lock periods and APR amounts.

As you continue, choose whether to stick with the 1.8% base APR with no lock-up period or lock your stake for up to 365 days for an increased APR. The bottom of the box displays your estimated rewards with either option.

Once you have staked, you’ll begin to earn rewards actively. 15% of the rewards you earn will be distributed as a fee to the node to which you’ve delegated your stake.

To increase your FTM stake amount at any time, you can repeat the process above to create a new delegation. As such, you can actually create several delegations with multiple lock-up periods if you wish.

Keep in mind there is a 7-day unbonding time if you unstake your FTM. Additionally, while it is possible to unstake your FTM before your chosen lock-up period ends, you’ll receive only half of the base rate of 1.8% APR rewards; however, since you receive rewards actively, the penalty will actually be deducted from your staked FTM as you unstake.

Let’s consider an example. You stake and lock 100,000 FTM for one year, giving you a 6% APR which equals 6000 FTM in total rewards. Around day 300, you’ll have received almost 5000 FTM, at which point you decide to unstake before the one-year period ends.

Your updated APR is 0.9%, which is half of the base rate. With your 100,000 FTM, your rewards would equal 900 FTM. However, since you’ve already received 5000 FTM, you’ll receive only 95,900 FTM when you unstake to account for the extra 4100 FTM in rewards you forfeit by unstaking early.

As such, you will never receive less FTM than you staked originally.

Liquid staking on Fantom

The Fantom platform hosts several dApps that offer liquid staking to users, provided mainly by Beethoven X and Ankr.

When you stake normally on Fantom, your stake is locked and inaccessible. However, liquid staking is a solution that allows users to stake their tokens while still having access to their liquidity.

Liquid staking services on Fantom let users stake their FTM and receive staked-FTM tokens on a 1:1 basis. These tokens track the price of FTM, and holders can use them across a variety of DeFi applications while still earning staking rewards.

Read our full guide on how to liquid stake on Fantom.

Frequently asked questions

- How do I run my own node on Fantom?

Please refer to our documentation to learn how to set up a node on Fantom. - Are my tokens safe when I stake?

Yes. Only you have access to your tokens. Make sure not to lose your seed phrase or private key. - Can I lose my tokens when staking?

If you stake to a validator node that acts maliciously, you can lose all your staked tokens.

You must choose the validator node wisely and make sure they’re reputable. Slashing both delegators and validators, instead of only the latter, is an essential part of network security. It makes it costly for a set of bad actors to take over the majority of the network. - How do I choose a reputable validator?

Most validators for Fantom have active communities, websites, and Twitter accounts. Do your own research and ask around in the community; they will be able to help you. - Can a validator run away with my funds?

No. A validator does not have access to any tokens other than their own. However, if a validator acts maliciously, all the funds staked to that node can be lost. - Can staking APR change?

Yes. Staking rewards can change if a governance proposal passes that aims to change the APR.