Getting started with Liquid Staking

New Fantom users frequently ask whether to stake their tokens or put them to work in DeFi protocols. Luckily on Fantom, the question isn’t either/or.

Turning to one of the multiple liquid staking options on the network makes it possible to both stake and participate in DeFi.

In this post, we explain what liquid staking is and offer detailed guides on getting started with the major liquid staking protocols that currently serve the Fantom ecosystem - Stader Labs, Beefy, and Ankr.

Please note that:

- This article presumes that you are comfortable using browser wallets like Metamask to connect to and engage with dApps. If you are just starting on Fantom, please review our Ultimate Guide to the FTM token.

- This article is intended for informational purposes only and does not represent financial advice. We encourage all users to decide if liquid staking is right for them and to familiarize themselves with different liquid staking providers' specific rules and practices.

What’s liquid staking?

One of the best ways to contribute to the Fantom network is as a staker. Users who stake their FTM contribute to the security of the network, and in return, they earn regular and stable rewards for their participation.

Staking can yield a steady, healthy return, but once locked with a validator, the tokens lie idle in terms of providing additional earnings opportunities. Simply put, their value is untapped.

Liquid staking is an innovation in the staking economy that solves this dilemma: liquid staking providers offer services on Fantom that enable users to stake their FTM and then receive staked-FTM tokens that can be used in DeFi applications.

For example, imagine that you’ve carried out your research and selected a liquid staking provider that meets your requirements. After connecting your wallet to that provider’s platform, you stake 100 FTM and mint staked-FTM, usually on a 1:1 basis.

While you earn staking rewards, you can then use the staked-FTM in any DeFi application that supports those liquid staking tokens.

Most liquid staking providers allow you to unstake at any time, often with a short waiting period for the original FTM tokens to be unlocked.

Getting started with Liquid Staking

The guides below indicate first steps to liquid staking with Stader, Beefy, and Ankr, respectively.

Guide to Stader Liquid Staking

Guide to Beefy Finance Liquid Staking

Guide to Ankr Liquid Staking

Stader Labs

Stader Labs is a multi-chain liquid staking protocol, with ~$150 million TVL and over 27 million FTM already staked on the protocol.

sFTMX is a liquid token that you get when you stake your FTM with Stader. sFMTX represents your staked FTM, which you can swap at a later date for your originally staked FTM, and additional staking rewards.

Meanwhile, you can use sFMTX on multiple Fantom protocols to participate in DeFi.

sFTMX is a yield-bearing token that acts like a receipt for the tokens deposited/staked – this type of token is sometimes called a cToken. As staking rewards accrue, sFTMX increases in value relative to FTM . This short video illustrates how this works.

What are the top highlights of sFTMX?

- ~4.7%+ APY: sFTMx will deliver maximum staking rewards, typically reserved for 365-day lock-ins, while also allowing for instant liquidity on DEXs.

- Max DeFi interoperability: The design of sFTMx as a cToken allows for easy integration with all types of DeFi protocols. This means the staking rewards are only the beginning of sFTMx’s potential.

- Decentralization: When you stake with Stader, your assets are automatically distributed across a set of carefully chosen validators. This supports Fantom decentralization while minimizing slashing risks.

Connect your wallet to Stader Labs

To connect your wallet, you can either:

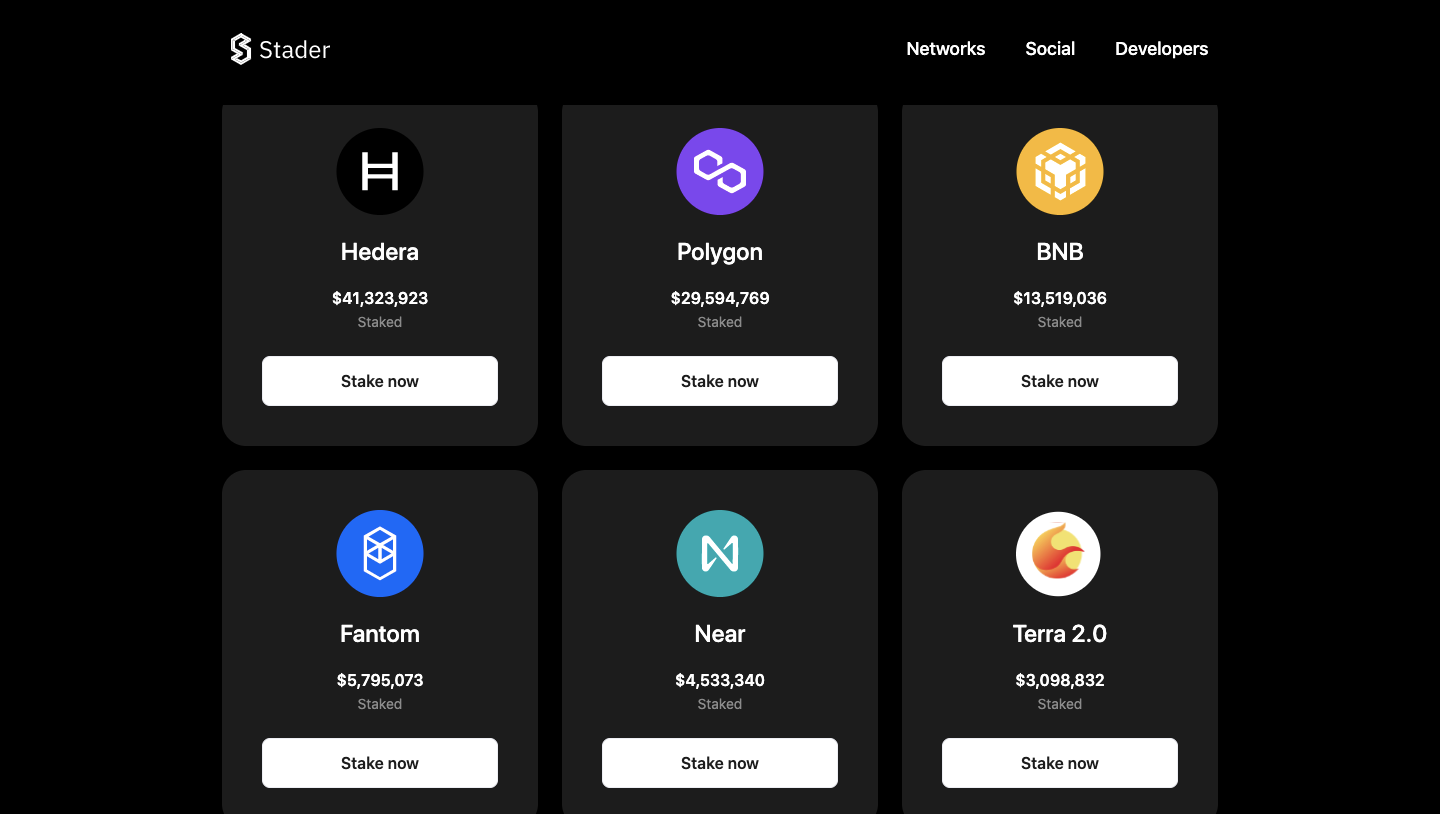

- Go directly to the Fantom Staking page or

- Visit Stader Labs, scroll down to the Supported Networks section, and click Stake Now under Fantom.

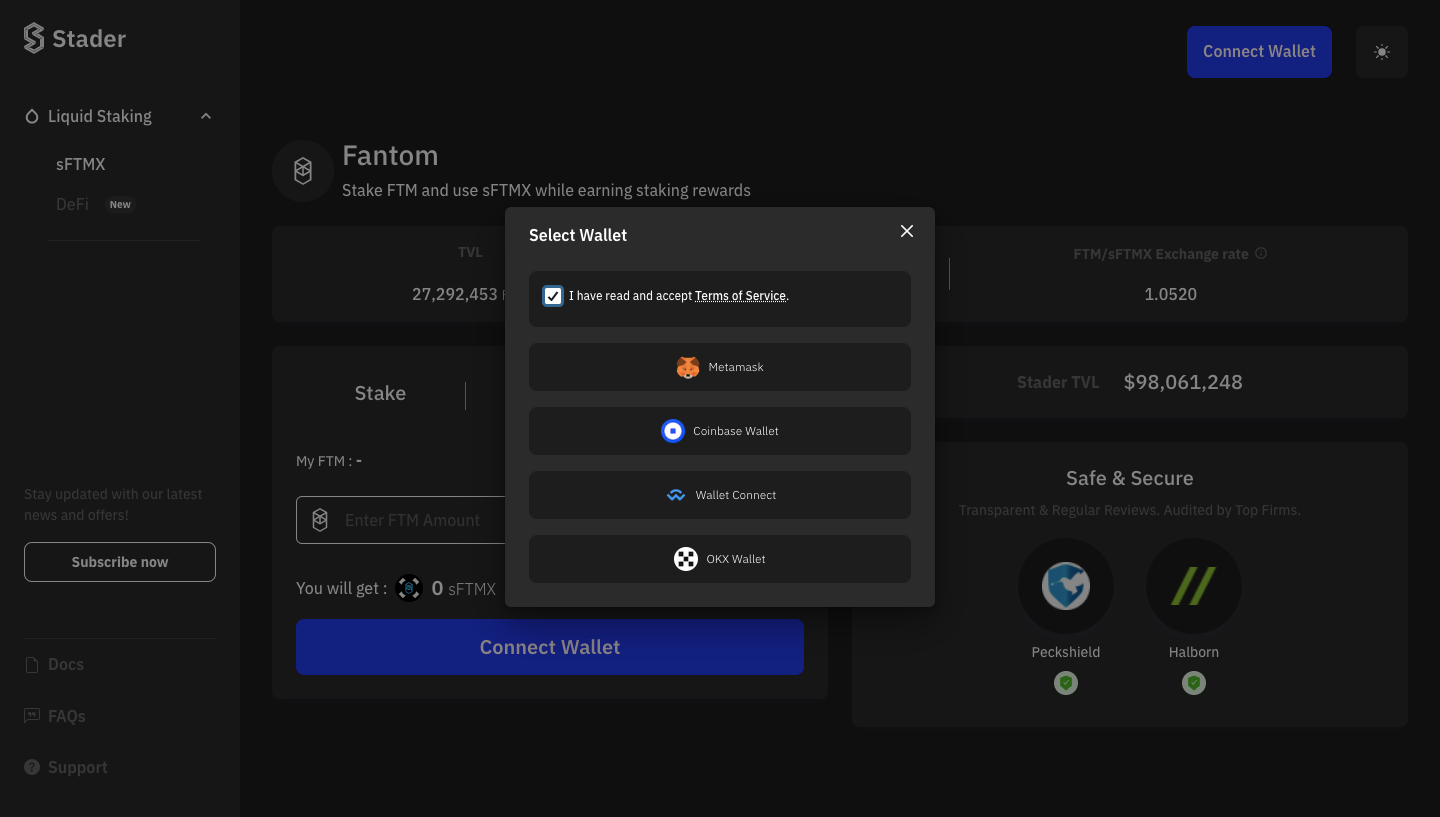

- Click on Connect Wallet

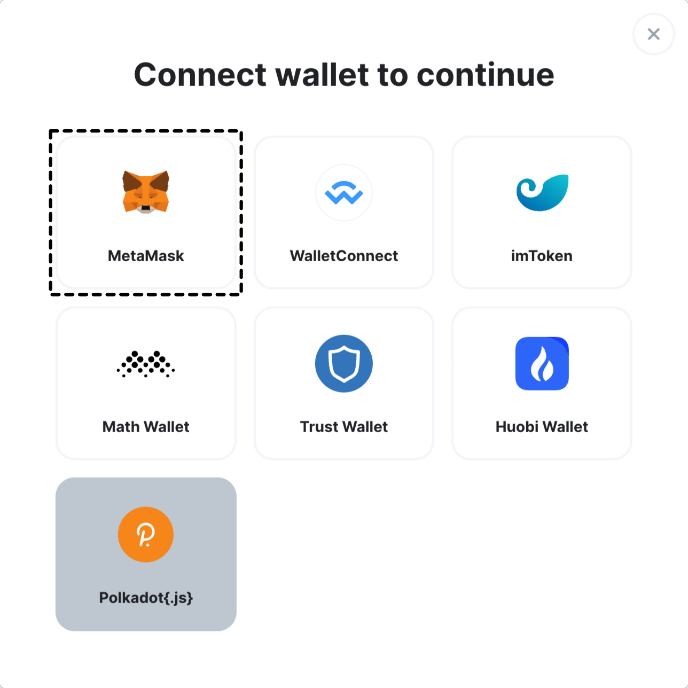

- Read the terms and conditions, click the selection box, and then select the Fantom wallet to which you want to connect. For this example, we use MetaMask.

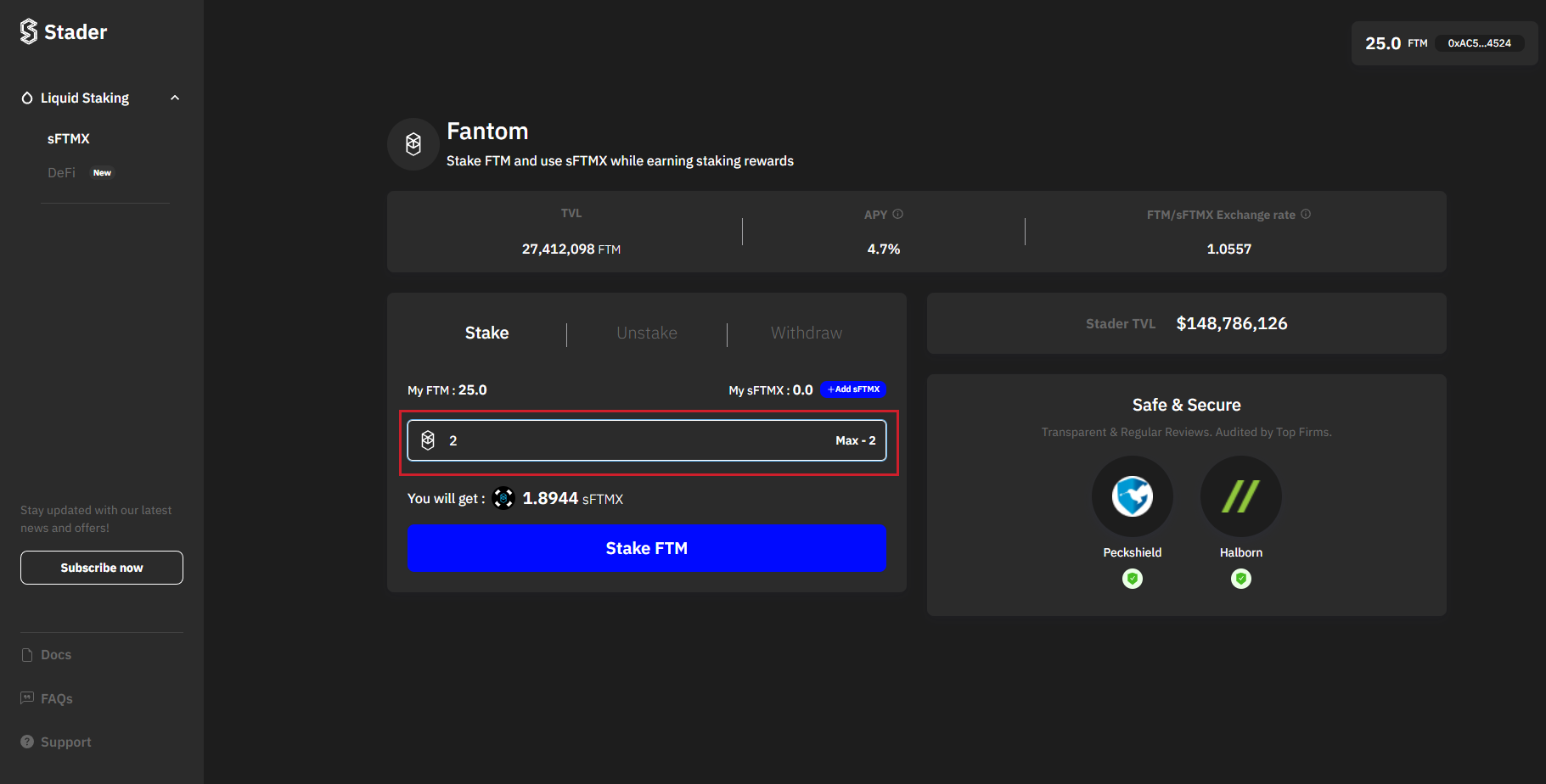

Stake your tokens

- Once you have connected your wallet, enter the amount of FTM you wish to stake. You can see the amount of sFTMX you’ll get based on the current exchange rate of FTM/sFTMX. sFTMX behaves like a yield-bearing token, growing in value with respect to Fantom over time, with the yield coming from staking rewards. Note: you can use the “Max-2” feature to stake the maximum available balance.

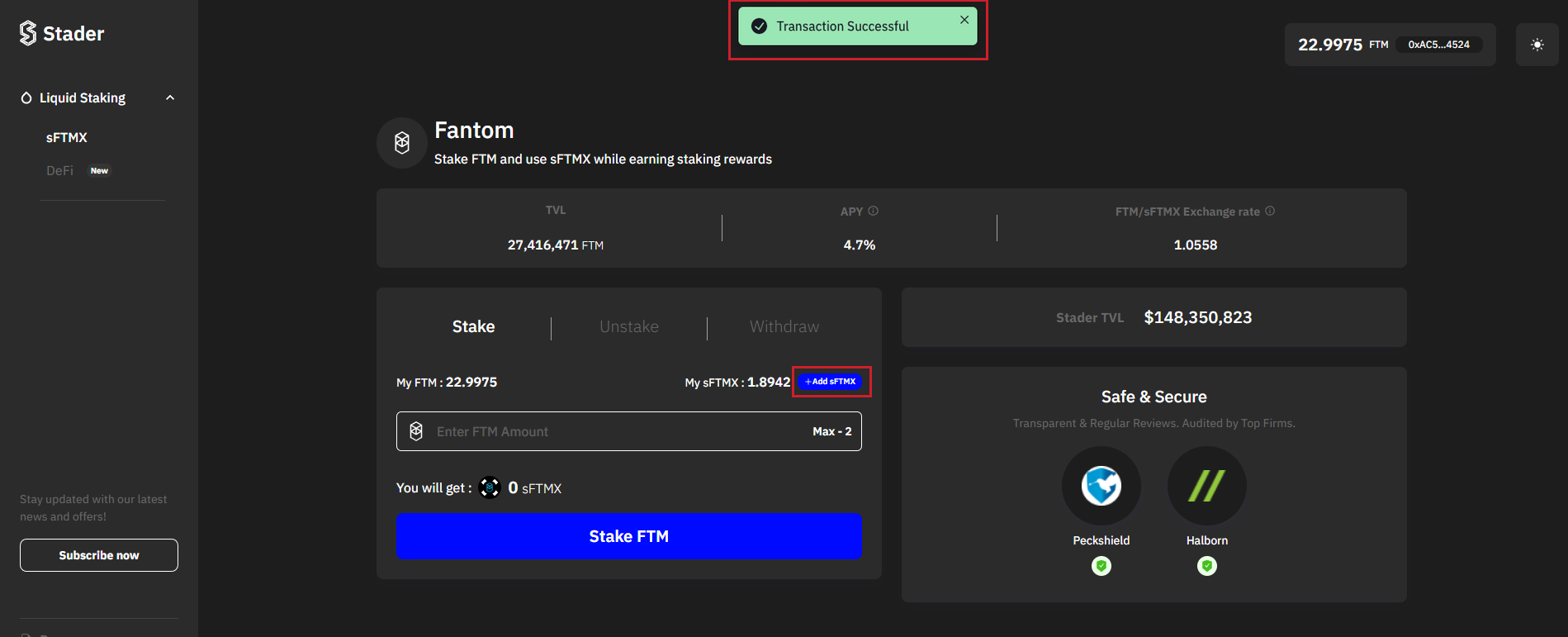

- Click Stake FTM and confirm the transaction in MetaMask.

- Post-transaction, you’ll see the transaction confirmation message. Now, sFTMX has been added to your wallet, and you’ll begin to earn staking rewards! Note: to view the sFTMX tokens in your wallet, click the Add sFTMX button just above the field where you entered the FTM amount to be staked.

DeFi with Liquid Staking

- sFTMX can be deposited to liquidity pools and used for yield farming and lending/borrowing across many of the major DeFi protocols on Fantom

- sFTMX integrates with many DeFi protocols, including

- DEXs like BeethovenX and SpookySwap

- Lending & Borrowing protocols like Granary Finance

- Yield Optimizers, from vaults and auto-compounders on Reaper farm and Liquid Driver to leveraged yield farming on Tarot.

How to Unstake FTM

Firstly, note that you can swap your sFTMX on DEXs like BeethovenX and SpookySwap for instant liquidity.

You can also unstake directly on Stader dApp. Note that while Stader maximizes yield for users by locking in FTM deposits for 12 months, Stader has designed a mechanism to support a pool that allows users to unstake for free.

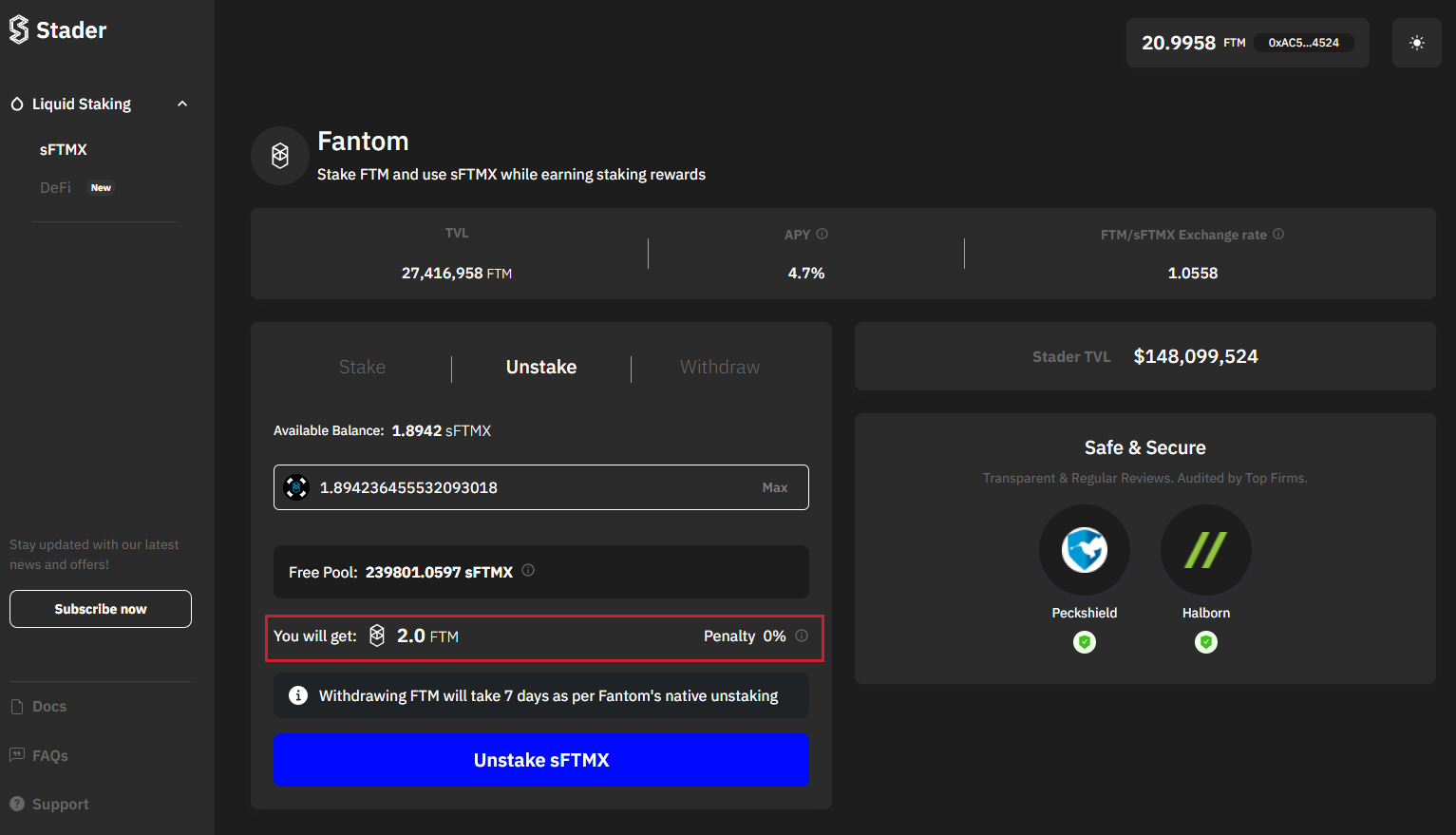

Stader holds new deposits and maturing funds (after lock-in expiry) for ~5 days before staking and locking them. This dynamic reserve constitutes the “Free pool.” When withdrawal requests are made within this limit, users will get FTM per the prevailing sFTMx <> FTM exchange rate.

Suppose the user’s unstake amount exceeds the free pool. In that case, FTM is given back to the user after deducting a small penalty on the prevailing sFTMx <> FTM exchange rate. This penalty reflects the loss that Stader bears for unstaking prematurely and losing accrued rewards, as occurs with Fantom native staking.

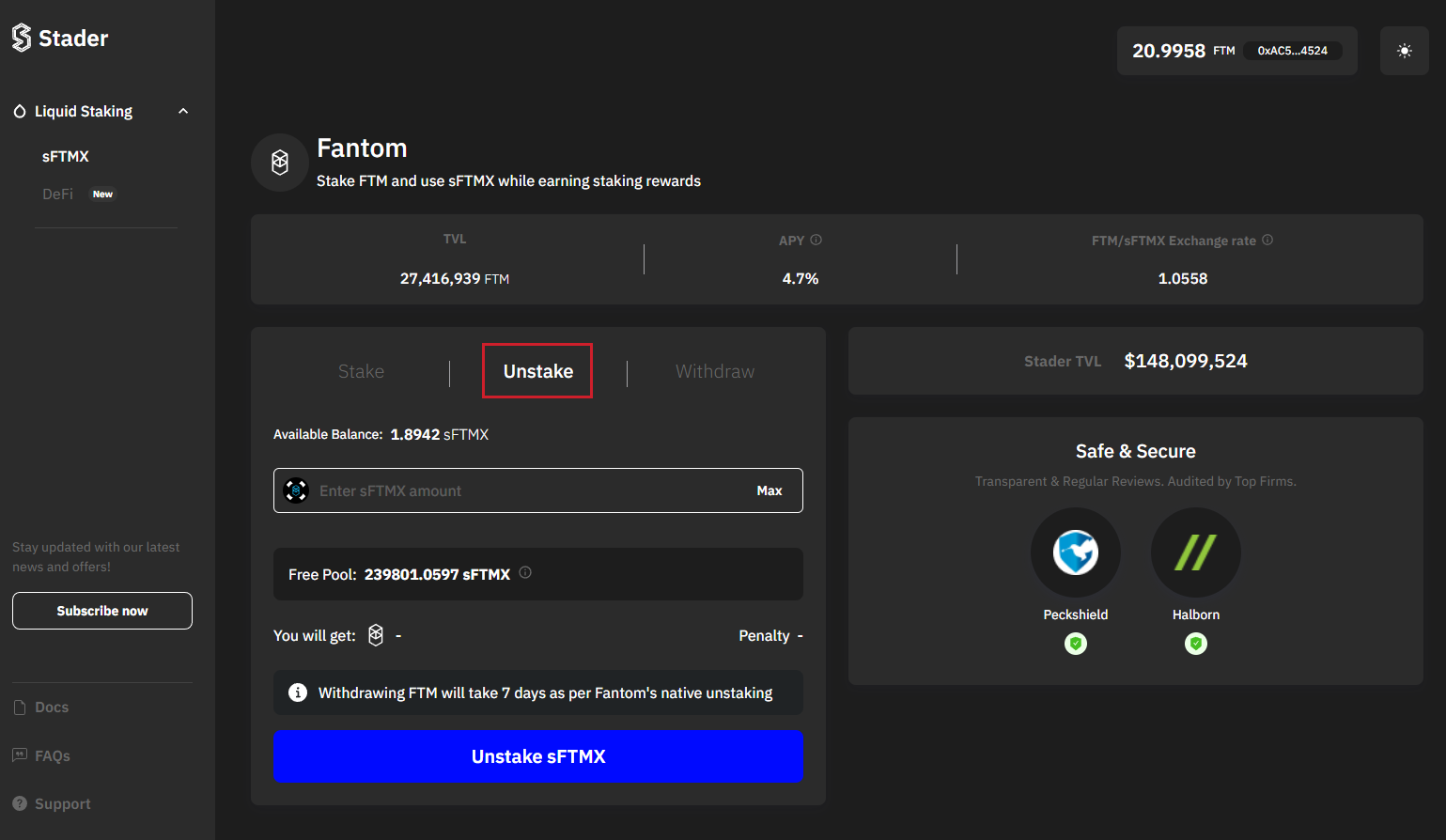

- Click the Unstake tab. You can see your available sFTMX balance on this screen.

- Enter the amount of sFTMX you wish to unstake. You can see the FTM amount you’ll get based on the exchange rate of FTM/sFTMX.

- Click Unstake sFTMX and confirm the transaction in your wallet. Note that withdrawing will take seven days, as per Fantom native unstaking.

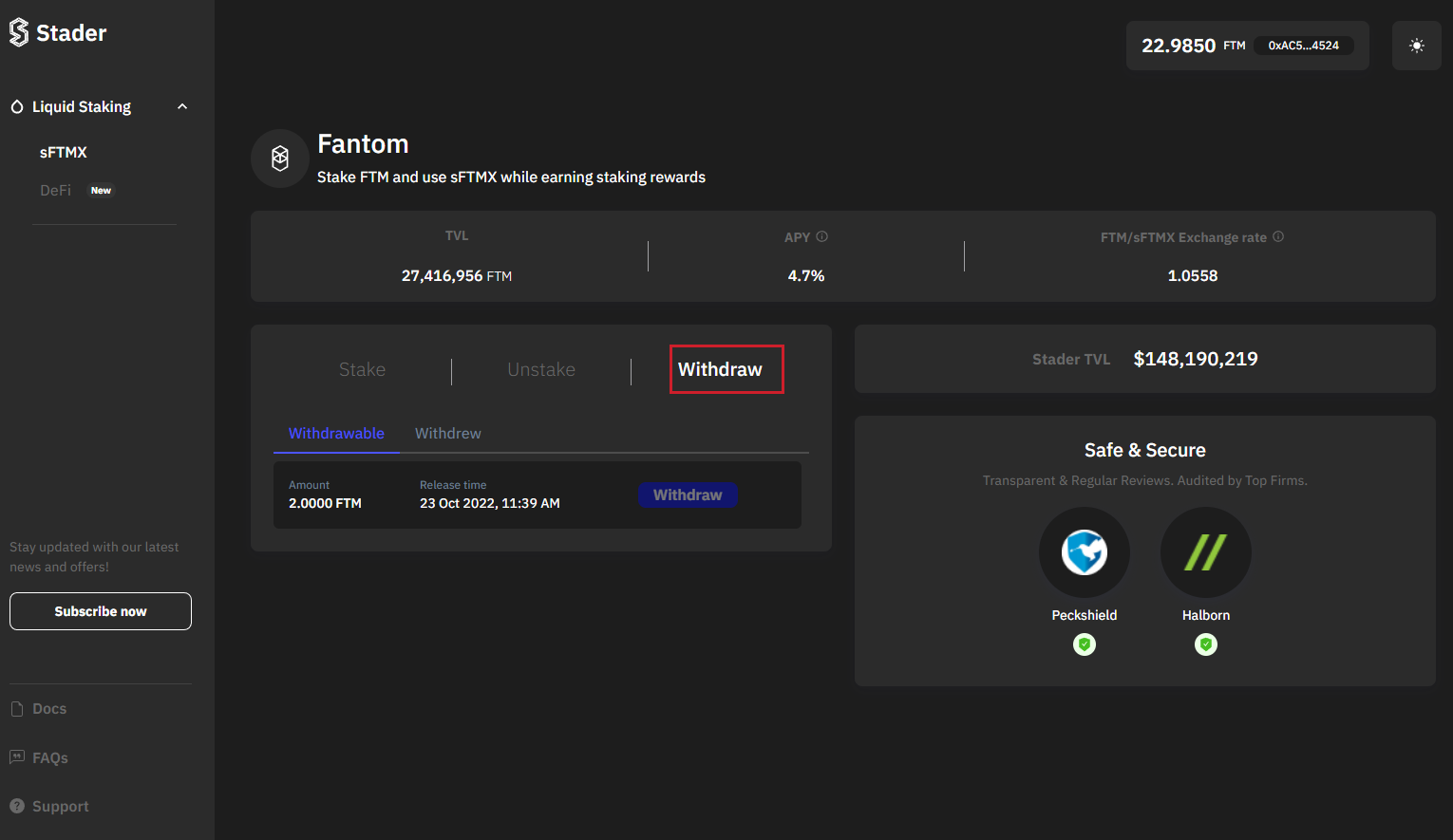

- Click on the Withdraw tab on the Stader Liquid Staking dashboard for a withdrawal request history. Once the seven-day release period has been reached, you will need to return to this page and click Withdraw to release your FTM.

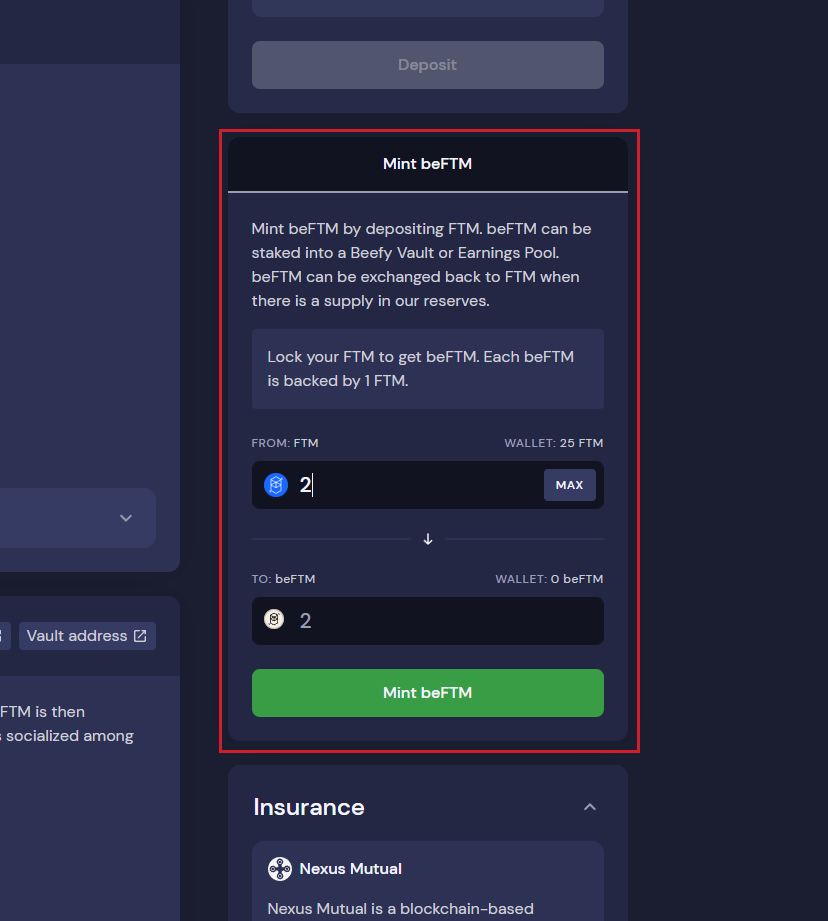

Beefy Finance

beFTM is a liquid staking solution provided by Beefy. The beFTM token is 1:1 backed by FTM and can be staked on the Beefy platform and on the farms of major DEXes.

To obtain beFTM, you must first deposit FTM in the Beefy Delegator Vault.

Deposited FTM is then used to buy beFTM from a liquidity pool or minted 1:1 depending on which is most profitable for the user. beFTM can also be purchased on many DEXes such as BeethovenX, SpiritSwap, and SpookySwap.

The collective staked pool of FTM is delegated to Beefy’s validator and perpetually locked at the maximum time of 51 weeks to earn optimized validator rewards. Beefy supplies 1/15 of the deposit to its validator, so it never hits the delegation limit.

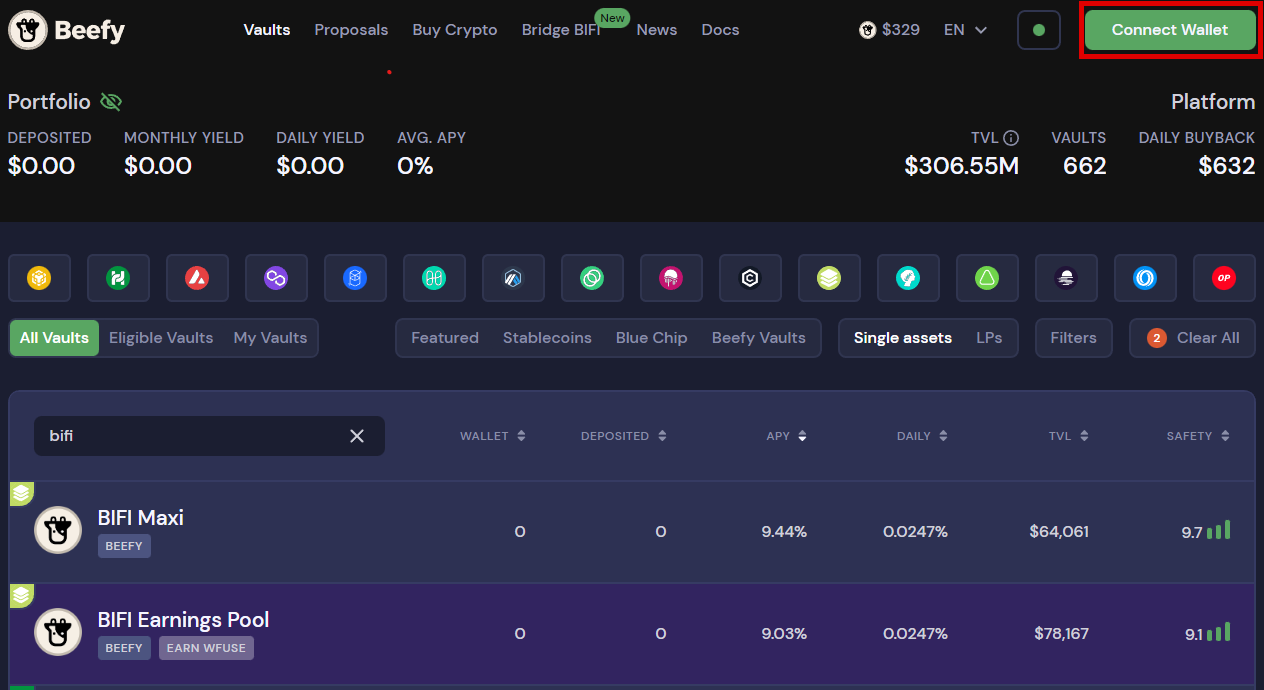

Connect your wallet to Beefy

- Visit Beefy and connect your wallet by clicking the Connect Wallet button in the top right corner.

- Select the appropriate wallet. For this example, we’ll use MetaMask.

Stake your tokens

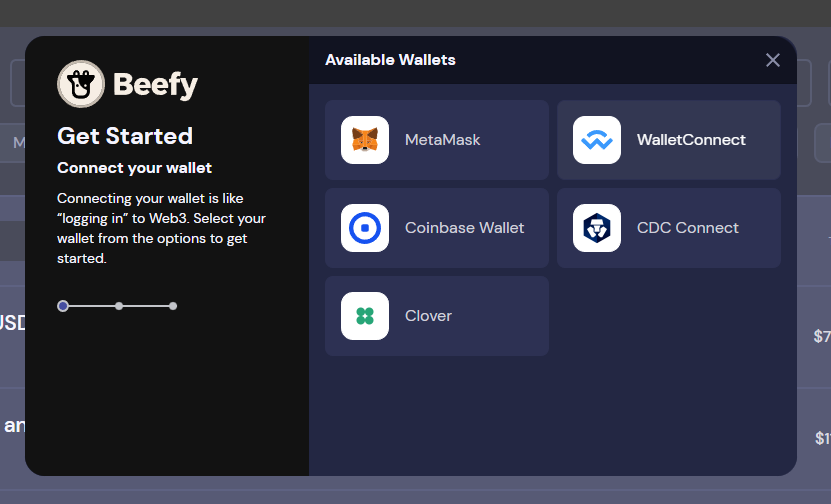

- Search for beFTM in the search bar, and select the beFTM Vault.

- Scroll down the page to the Mint section. Here, input the amount of FTM you wish to stake and check the amount of beFTM that you will receive.

- Click Mint beFTM and pay gas fees via your wallet.

DeFi with Liquid Staking

There are three main ways you can begin earning with your liquid beFTM:

- Deposit beFTM in the beFTM Vault for compounded interest in the form of more beFTM.

- Deposit beFTM in the WFTM Earnings Pool for simple interest with WFTM rewards.

- Stake in beFTM-FTM liquidity pools on all the major DEXs on Fantom.

To learn more about the possibilities of liquid staking with beFTM, check the Beefy docs and guide for everything you need to know.

How to Unstake FTM

- To convert your beFTM back to FTM, use any swap dApp like SpookySwap or SpiritSwap.

Ankr Protocol

Fantom Liquid Staking with Ankr Staking means that Ankr stakes your FTM tokens with the help of its various nodes. Ankr then distributes rewards daily.

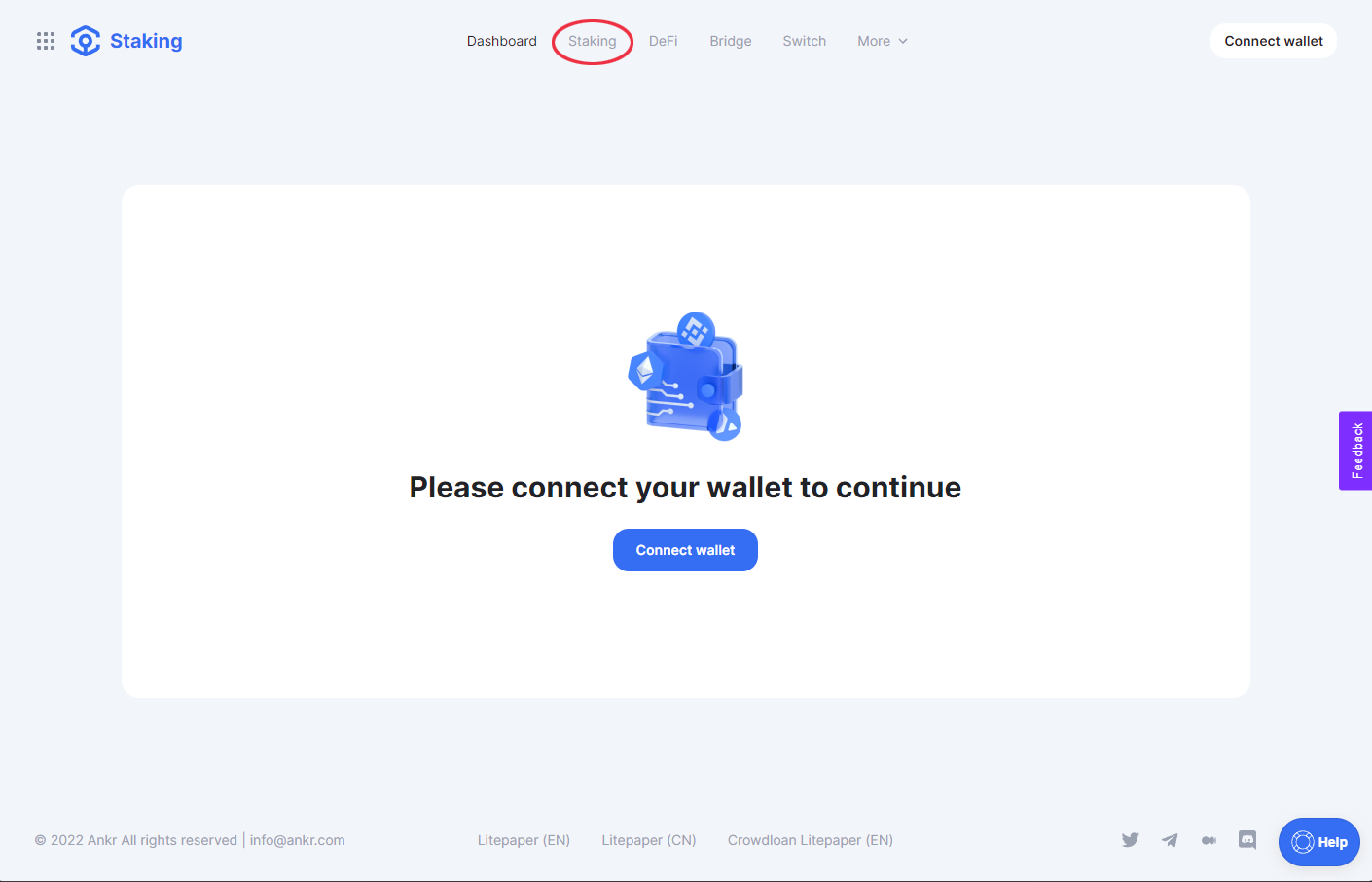

The first step to liquid staking FTM with Ankr is connecting a wallet to the dashboard.

Connect your wallet to Ankr

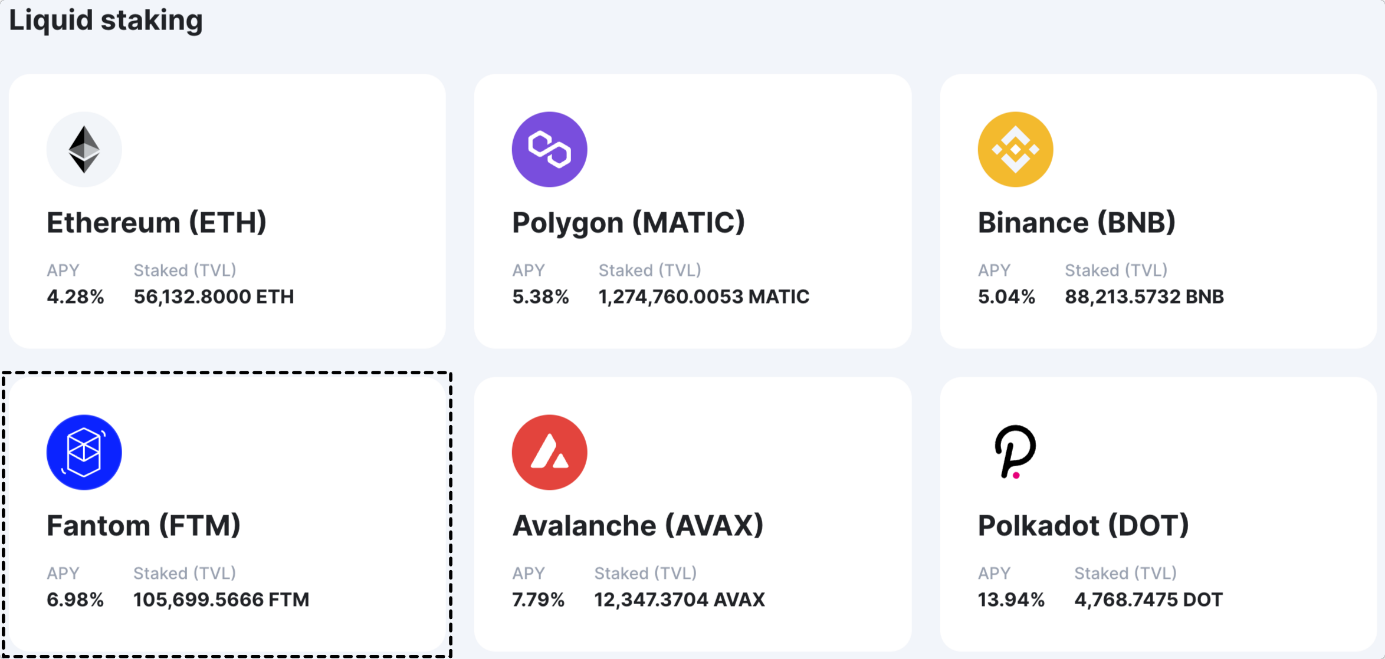

- Visit Ankr Staking and click Staking in the product menu.

- Mouse over the Fantom (FTM) box and click the Stake button.

- Select the Fantom-supported wallet to which you wish to connect. For this example, we use MetaMask.

Stake your tokens

After completing these steps, you are now ready to start staking FTM and earning liquid staking tokens.

Before continuing, make sure you have a small surplus of FTM to pay the gas fees for the staking transaction.

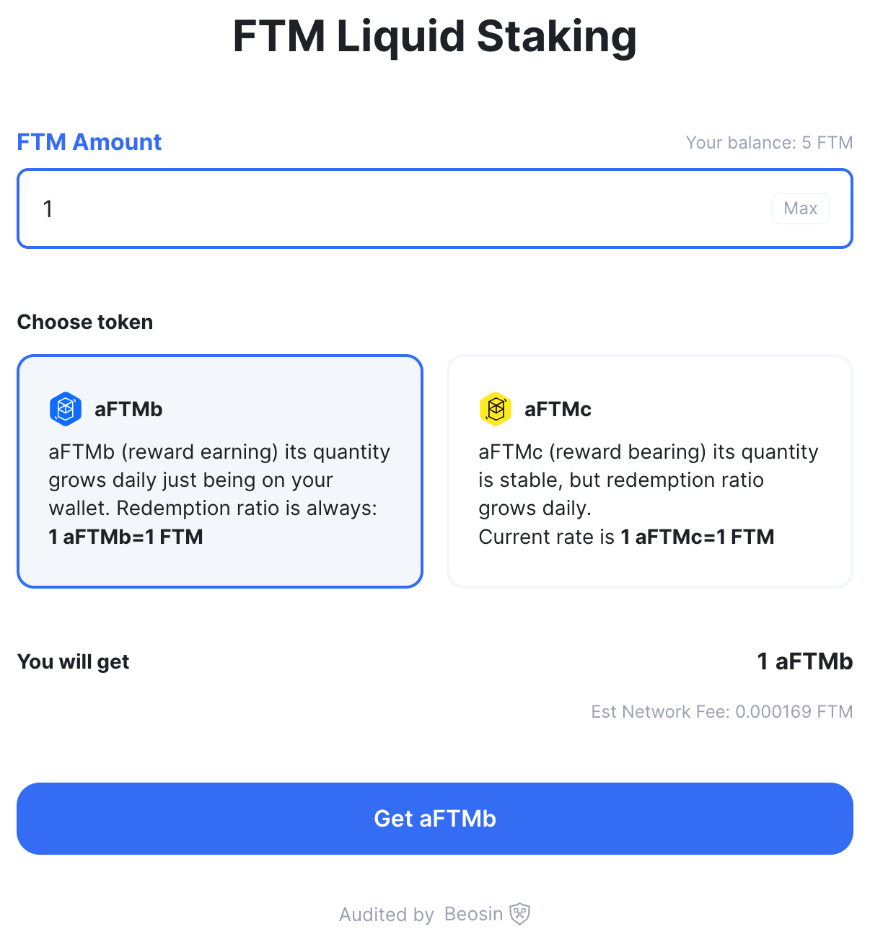

- Visit Ankr Staking and connect your wallet as indicated above to access the Fantom staking dashboard.

- Enter the desired FTM Amount to stake, choose the desired liquid staking token, and click Get aFTMb or Get aFTMc.

Note: aFTMb is reward-earning, meaning that its quantity grows daily as you hold it, reflecting staking rewards. The redemption ratio is always 1 aFTMb = 1 FTM.

aFTMc is reward-bearing, meaning that its quantity is stable, but it gains in value such that its redemption ratio grows daily to reflect staking rewards.

This means that after some time, if you choose to redeem aFTMc for FTM, you’ll get more FTM than you originally staked to reflect staking rewards.

- Confirm the transaction in your wallet.

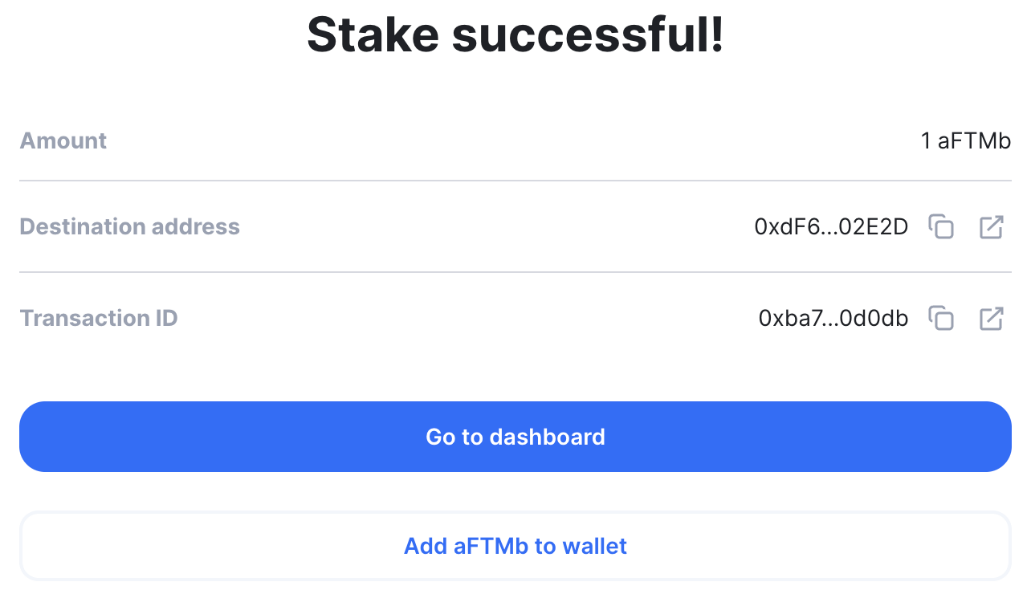

- On the next page with the “Stake successful!” message, add the liquid staking token to your wallet by clicking Add aFTMb to wallet or Add aFTMc to wallet. Confirm adding the token to your wallet.

- Click Go to dashboard to see your stake. You may need to wait for a short time for the transaction to finalize and for the dashboard to automatically update.

Your aFTMb balance will automatically increase daily, reflecting the Fantom Staking rewards, while your aFTMc amount will remain the same but grow in value in relation to FTM over time.

DeFi with Liquid Staking

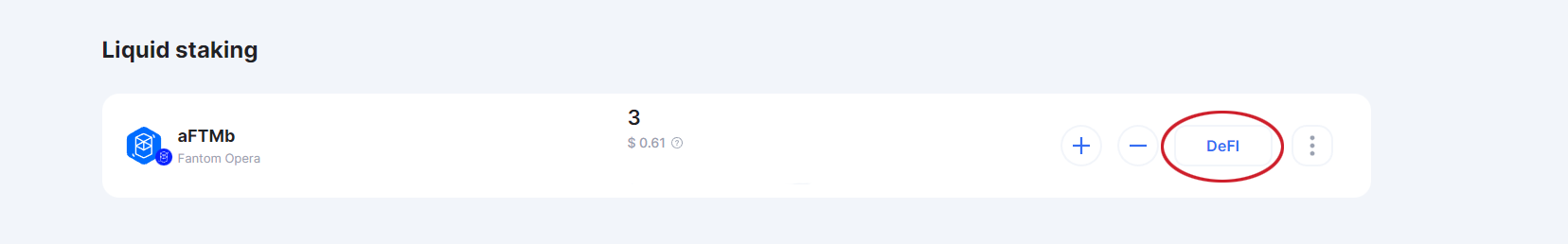

- From the Dashboard, scroll past the My Portfolio section to Liquid Staking. Click DeFi.

- You can use aFTMb/aFTMc staked tokens to earn additional layers of rewards on the platforms listed in DeFi.

How to Unstake FTM

Firstly, note that you can swap your aFTMb/aFTMc on SpookySwap.

You can also unstake directly on Stader dApp.

Before starting, ensure you have a small amount of FTM for the gas fee.

Unstaking also applies an unstake fee that depends on the current liquidity and amount to unstake. The fee is deducted from the unstaked amount.

Unstaking FTM tokens is a multi-step process involving sending several transactions to the FTM smart contracts deployed on the Binance Chain and BNB Chain.

FTM tokens are transferred to your wallet automatically when the unstaking process completes. There is no additional cost for this.

To unstake FTM on Ankr Staking:

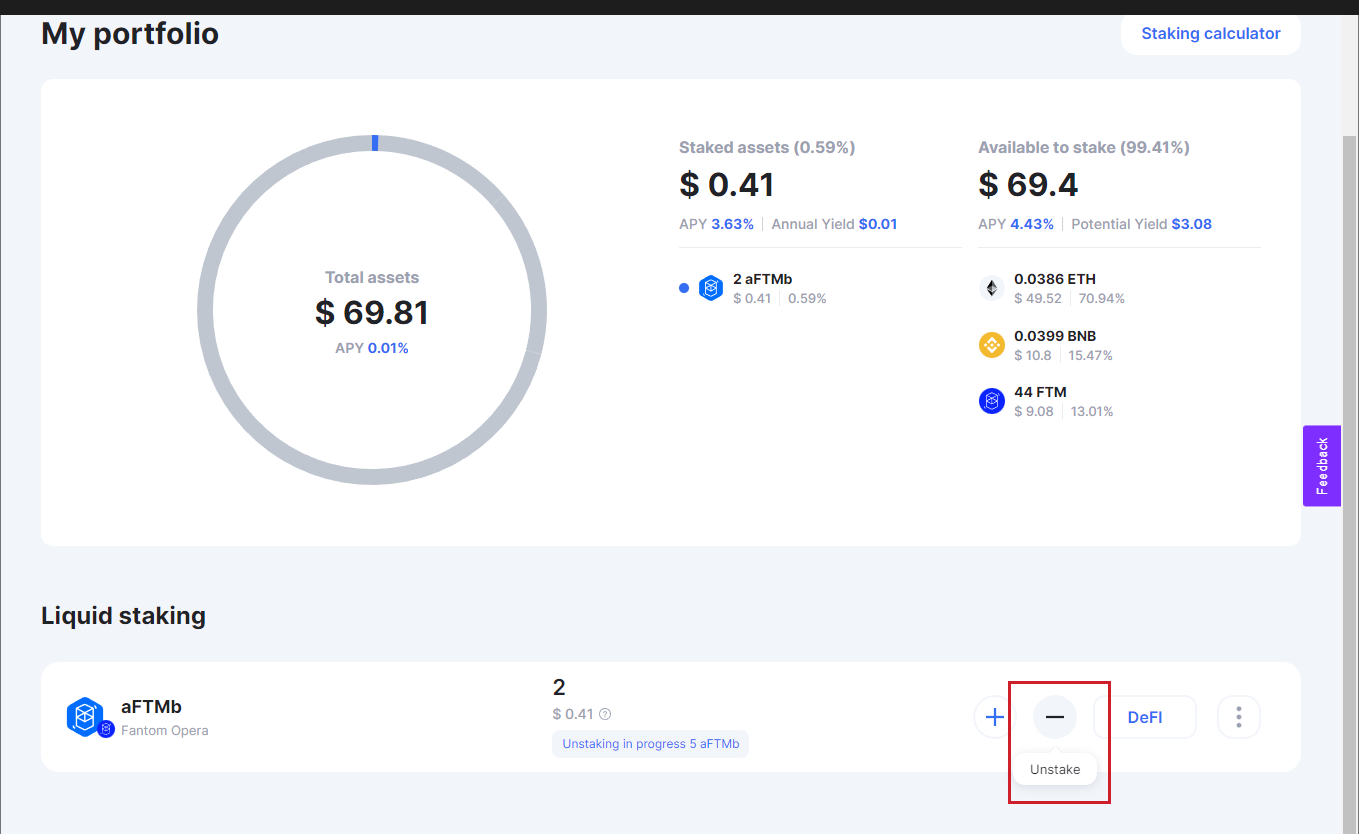

- Open the Ankr Staking Dashboard.

- Locate the aFTMb or aFTMc box – depending on what you hold – and click the '-' icon to unstake.

- Enter the amount to unstake and click Unstake.

- To finalize, grant access to your wallet and confirm the unstaking transaction.

Once the transaction is confirmed, the Ankr Earn Dashboard updates to show Unstaking in progress.

You can stake and earn rewards on Ankr with as little as 1 FTM, just like on Fantom. You can also stake and unstake FTM as frequently as you like, with no limits whatsoever.

Engage with Stader Labs

Website | Discord |Twitter | Telegram | Blog | Medium | Whitepaper

Engage with Beefy Finance

Website | Twitter | Medium | Discord | Telegram | Reddit

Engage with Ankr

Website | Discord | Twitter | Telegram Announcements | Telegram | Instagram | Whitepaper