Understanding Fantom transaction fees

Fantom has always been known for its fast transaction speeds and low fees. We’ve already addressed best practices for measuring blockchain speed, but what about transaction fees? What is a transaction fee? How are fees calculated, and how much does it cost to use Fantom?

Recent upgrades to the network and revisions to Fantom’s fee structure have made it cheaper than ever to engage on the network. For most transactions, fees are less than $0.01, even during high-traffic periods. Compare this to Ethereum, where even the most basic transactions can cost well over $1.

This article has several aims. We cover:

- What gas and transaction fees are

- How and why fees fluctuate

- Recent upgrades and where Fantom is going

- A comparative overview of current fees on Fantom and Ethereum.

What are transaction fees?

Transaction fees are paid to validators who expend processing power to confirm transactions on Fantom. Validators share these fees with the stakers who have delegated with them.

Processing power reflects energy consumed, so we can also say that the low-energy requirements of Fantom’s consensus method play a role in helping to keep transaction fees lower.

What is Gas?

Every transaction on the network consumes processing power, which is measured and quantified in terms of Gas.

Gas is different from FTM: as a measurement of work, it cannot be bought and sold on a market. But gas does have a price that changes over time, based on the supply and demand of the network’s computational power.

Gas price is represented in Gwei, where 1 Gwei = 10-9 * (network token). On Fantom therefore, 1 Gwei = 0.000000001 FTM.

Different types of transactions have different gas limits depending on their complexity; a simple process like a wallet funds transfer, for example, costs less in Gas than executing a complicated smart contract transaction.

While the amount of Gas required for any transaction, such as a payment, staking, etc., remains constant, Gas price is dynamic and rises and falls according to network traffic.

Taking these factors into consideration, the calculation for transaction fees is:

Transaction fee = price per unit of Gas * amount of Gas used

A simple analogy is to think of automobile fuel. All other factors being equal, I will always need one gallon in my car to do some amount of work ‒ delivering a constant X amount of power to the engine ‒ but the price of that gallon changes according to the market.

How are Gas prices determined?

We can track Gas prices over time on FTMScan.

To understand how prices fluctuate, consider that:

- Fantom sets a base fee for transactions indicating the lowest bound for transaction fees.

- The protocol tracks the average gas spent per second over periods of time. When network traffic rises, as certain thresholds of Gas spend/second are exceeded, the system raises the base fee to reflect the increased demand.

This price hike has the effect of stemming demand, as certain users might choose to wait to submit transactions until network traffic and Gas prices decline.

Ethereum similarly adjusts gas prices through a different combination of settings involving varying base fees and block sizes.

Why limit the supply of Gas by raising the price?

Every high-performance, EVM-compatible blockchain needs to throttle Gas supply with higher prices. Why? Network storage.

Consider that a new node has to sync with the chain from beginning to end. If a chain grows at maximum speed, syncing will never complete since the chain will grow faster than a node can sync. Raising prices normalizes overall traffic by lowering demand.

This syncing issue relates to a more generalized problem common to many blockchains: the sheer amount of data a node needs to store. With each additional block, blockchain data increases proportionally, creating “storage bloat.”

As the chain grows, nodes need ever-growing amounts of storage, and read/write times can take longer. Throttling gas speeds accounts, therefore, for the time that nodes require. As we’ll detail below, Fantom is in the advanced stages of solving this persistent data storage issue.

Paying more Gas for faster transactions

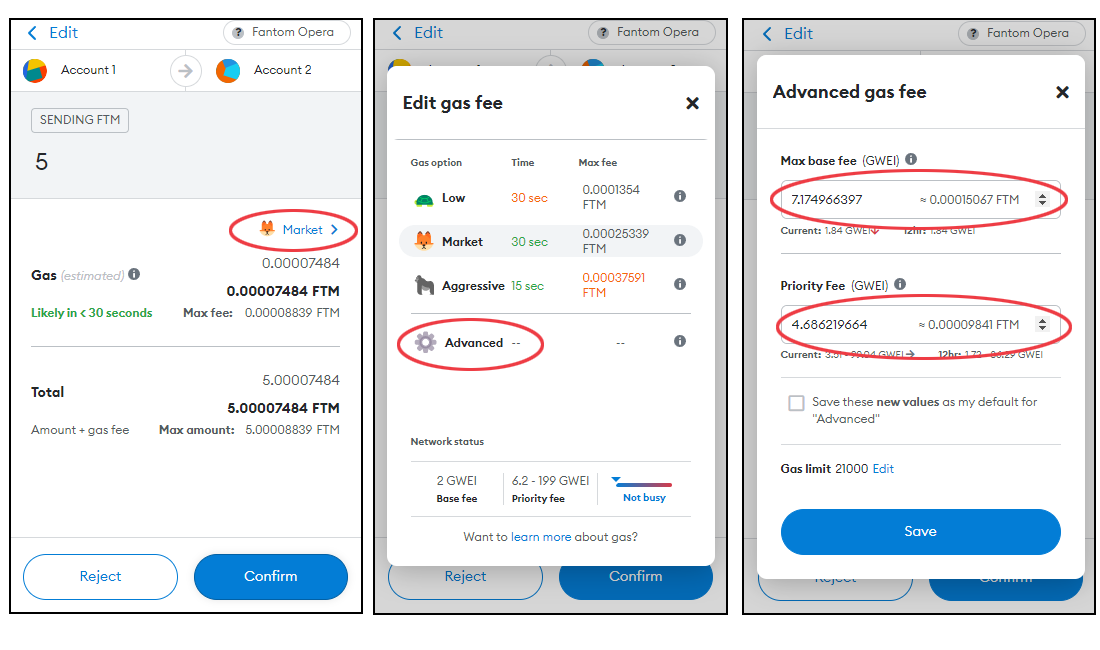

When a transaction is initiated, wallets like Metamask use the information from the previous block of transactions to suggest a Gas price that reflects the base fee.

As with Ethereum, Fantom users can, if they wish, manually adjust fees.

By clicking “Market” and selecting either a Gas option or “advanced,” users can raise the Gas fee to incentivize validators to process their transactions sooner.

However, recent upgrades to the network and generally high levels of throughput on Fantom make it unnecessary to overbid on Gas prices, even at moments of high network traffic.

Transaction fees now and in the future

To mitigate gas price volatility, Fantom this year implemented a Fantom-protocol-specific version of EIP-1559. This upgrade includes a fee balancer and network parameter settings that raise the maximum allowable Gas consumption from ~4-4.5Million/second to 10 Million/second at moments of high network traffic.

In addition to smoothing the rise and fall of gas prices, this improvement dramatically mitigates the need for users to overbid when submitting a transaction.

But lowering gas fees goes hand in hand with extending the scalability and speed of the network. Greater throughput means higher network capacity, which translates into lower costs.

Research conducted internally at Fantom demonstrates that blockchain data read/write times limit blockchain performance even more than smart contract execution times. In May 2022, Fantom implemented Snapsync to significantly decreases node sync times.

Fantom is concurrently working on several further network improvements, some of which were detailed in CEO Michael Kong’s recent presentation at Consensus 2022.

Comparing fees on Fantom/Ethereum

Let’s examine what costs are on Fantom.

We use both ETH and native FTM in Metamask wallets for our comparison. All transactions were carried out on a weekday, during what are typically considered peak hours on both the Fantom and Ethereum networks.

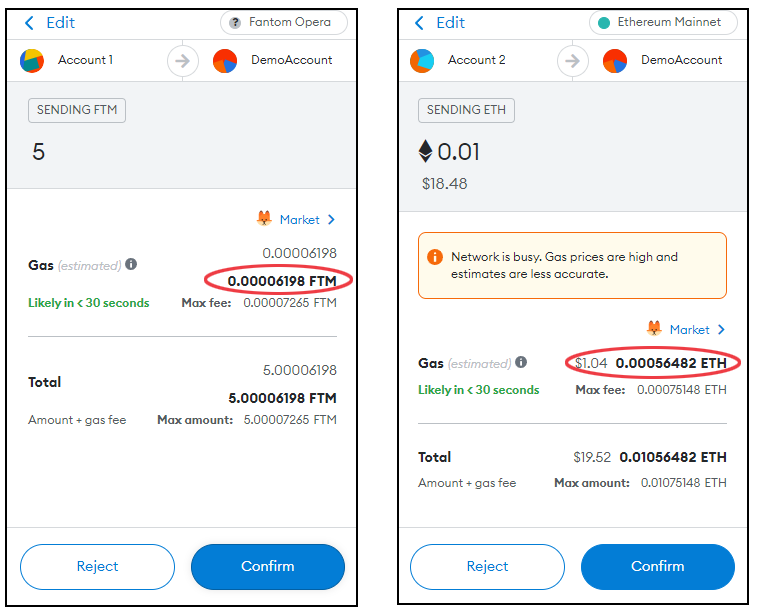

Wallet Transfers

For a simple transaction sending a small amount of crypto between wallets, we note that:

- On Fantom, a wallet transfer costs .000061 FTM, which at the time of writing is $0.00004.

- Such a transfer on the Ethereum network would cost $1.04.

Note that gas requirements are fixed and not dependent on the amount of crypto being transacted.

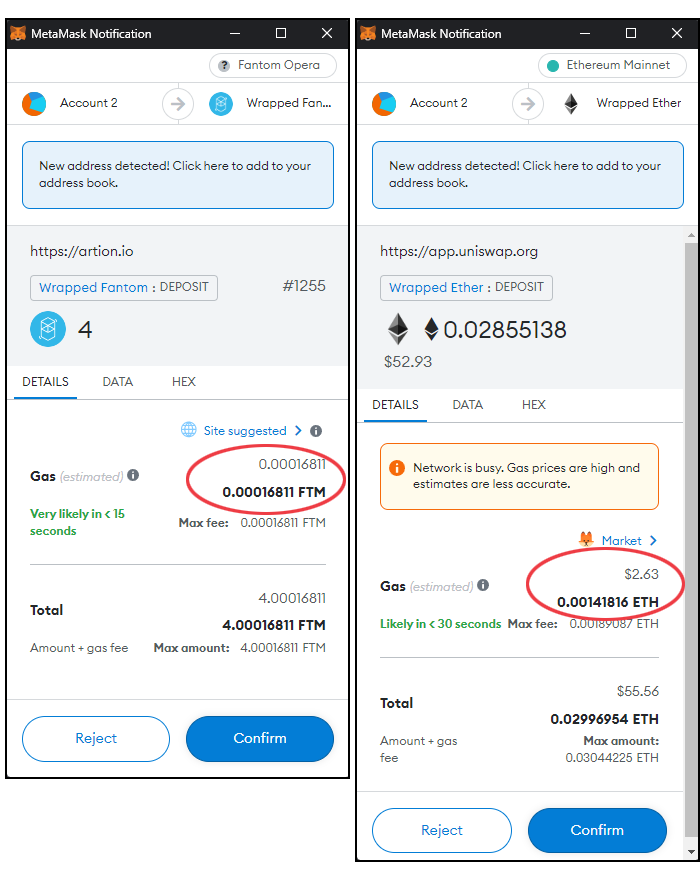

Wrapping FTM and ETH

For EVM compatibility, Fantom adopts the Ethereum token standards. For certain actions like bidding on NFTs, users need to wrap FTM or ETH before initiating a transaction.

We use the built-in wrap station in Artion and Uniswap to compare fees on Fantom and Ethereum, respectively.

- On Fantom, wrapping tokens costs about $0.00006 at the time of writing.

- On Ethereum, the fee is $2.63

Token Swaps and DeFi

We can use FTMScan and Etherscan to compare further network fees, keeping in mind that what interests us is not the protocol of choice ‒ SushiSwap or SpiritSwap, for instance ‒ but rather the costs of smart contract execution.

(Note: Gas fees listed below were recorded at the time of writing; depending on the current prices of ETH and FTM, respectively, they will show in the blockchain explorer as higher or lower than what is entered in the table.)

| Fantom | Ethereum | ||

| Txn type | Cost | Txn type | Cost |

| Add Liquidity | 0.00049010322077 FTM ($0.000199) | Add Liquidity | 0.002882499464895144 Ether ($5.42) |

| Token Swap | 0.01164945115061 FTM ($0.004715) | Token Swap | 0.002322801492187515 Ether ($4.36) |

| Mint NFT | 0.005162508 FTM ($0.002087) | Mint NFT | 0.002464749751305807 Ether ($4.64) |

These transactions entail engaging with relatively complex smart contracts. Across all transactions, fees on Fantom are orders of magnitude lower than on Ethereum.

Adoption starts with Accessibility

Much has changed since we proposed Fantom as an Ethereum Helper rather than a competitor: Fantom has evolved, and the ecosystem has grown exponentially.

But fundamentally, the situation and our ethos remain the same: Fantom’s EVM compatibility, speed, and low fees offer new and experienced crypto users easy and affordable options for any cryptocurrency use-case.