Opera Staking Model: Vote Information

We recently published details of a new staking model we're proposing to the community: Fluid Staking. The vote to decide whether this model is adopted will go live on Friday 3rd July 2020, 12 PM UTC, and will last for 7 days (ending Friday 10th July 2020, 12 PM UTC).

Please take some time to review the options carefully below, and see our guide to using the PWA Wallet for step-by-step voting instructions.

We'll announce the results of the vote as soon as they're available after voting closes, and if any changes to the SFC are required they will be implemented shortly after.

Fluid Staking (Option 1):

You can opt to ‘stake-as-you-go’ for a lower annual return or lock your tokens up for any period up to 12 months for a higher annual return.

Whether you choose to lock your tokens up or not, you will be able to claim and withdraw the rewards as they become available after a few epochs.

Rewards will not be subject to the same lock as the principal stake, so you will be able to compound your returns regardless of your lock-up period.

Unstaking will be subject to the usual 7-day unbonding period to guarantee network security.

If you choose to break your lock and unstake early, then you would be subject to a penalty: you will earn half of the base (stake-as-you-go) annualized rate for the period you’ve staked.

However, the SFC releases rewards as they’re accrued (at a higher ‘locked-up’ rate), so the penalty will be against your initial stake to compensate for tokens you have already withdrawn as rewards.

It’s important to note that it will not be possible to lose FTM from unstaking early. The SFC would only penalize against already withdrawn rewards.

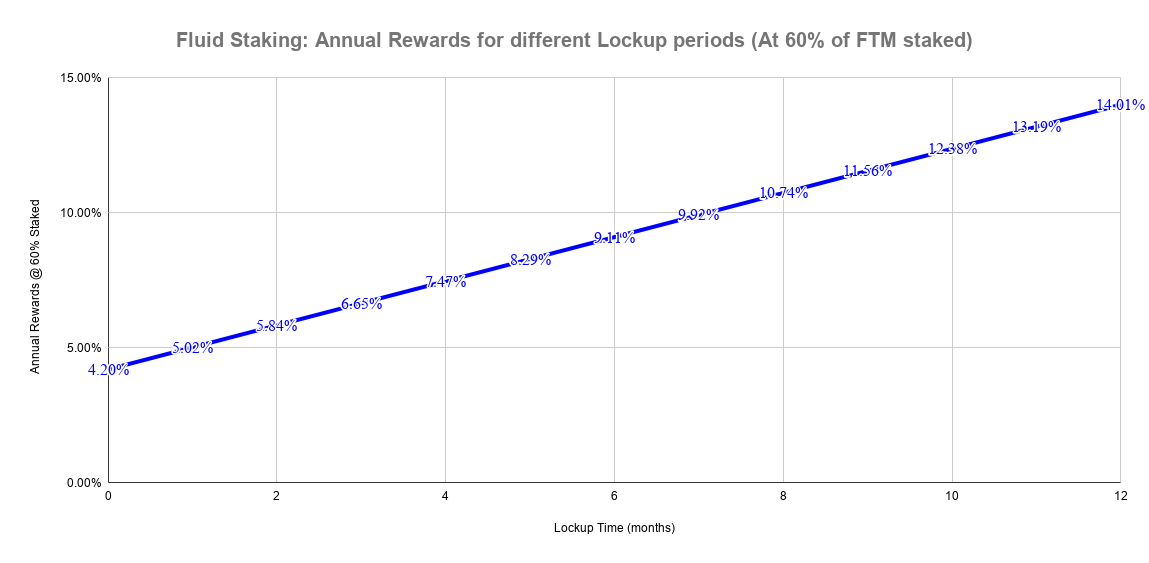

If you commit to a longer lock-up, you will earn more annualized rewards per FTM.

As in the current model, rewards will scale downwards linearly as staking participation increases. If the total tokens staked (not the staked percentage) increases by 10%, the annual rewards for each lockup period will be divided by a factor of 1.10.

@ 60% network staked: 4% for no lockup, 14% for 12-month lockup.

Any period in between these lockup periods: use a linear increase (6-month lock = [(14% - 4%) * 6m/12m] + 4% = 9%, 34.5 week lock = [(14% - 4%) * 34.5w/52w] + 4% = 10.63% etc.). Shown visually in the below graph:

Maximum inflation if everybody locks for 12 months and no early unstaking = 8.4%Expected inflation, using 6-month average lock = 5.4%

Status Quo (Option 2):

16.48 FTM per second distributed across the network at a flat rate (everyone receives the same percentage rewards on their staked FTM).

Rewards will be available to claim and withdraw as they're accrued, and unstaking will require the usual 7-day unbonding period.

@ 60% network staked: 36.56%, with fixed 22% inflation

Modified Status Quo (Option 3):

6.18 FTM per second distributed across the network at a flat rate (everyone receives the same percentage rewards on their staked FTM).

Rewards will be available to claim and withdraw as they're accrued, and unstaking will require the usual 7-day unbonding period.

@ 60% network staked: 14.01%, with fixed 8.4% inflation