Fluid Staking: A staking proposal

With the end of the initial 6-month reward lock coming to a close on 24th June, we've been thinking about the staking model Opera should adopt moving forward to best serve the Fantom ecosystem.

Internally, we've debated the positives and negatives of each potential model in great detail. We drew on knowledge and ideas from different areas of the team to reach a consensus on our position as a Foundation.

Now, we want to open the floor to the community.

Whether you have questions, suggestions, or concerns, we’ll use tomorrow's AMA as an opportunity to discuss staking; it's an excellent chance for the whole Fantom community to get involved and join us in our Discord server tomorrow, Wednesday 20th May @ 12 PM UTC.

We'll be using the session as a consultative measure; next month we’ll use on-chain voting to determine the outcome.

Note that the on-chain voting mechanism we'll use for this will be a simple smart contract to count weighted votes rather than a full-featured governance module that's still in the works.

Model 1:

Status Quo: 16.48 FTM per second distributed across the network at a flat rate (everyone receives the same percentage rewards on their staked FTM). Rewards will be available to claim and withdraw after a few epochs, and unstaking will require the usual 7-day unbonding period.

Model 2:

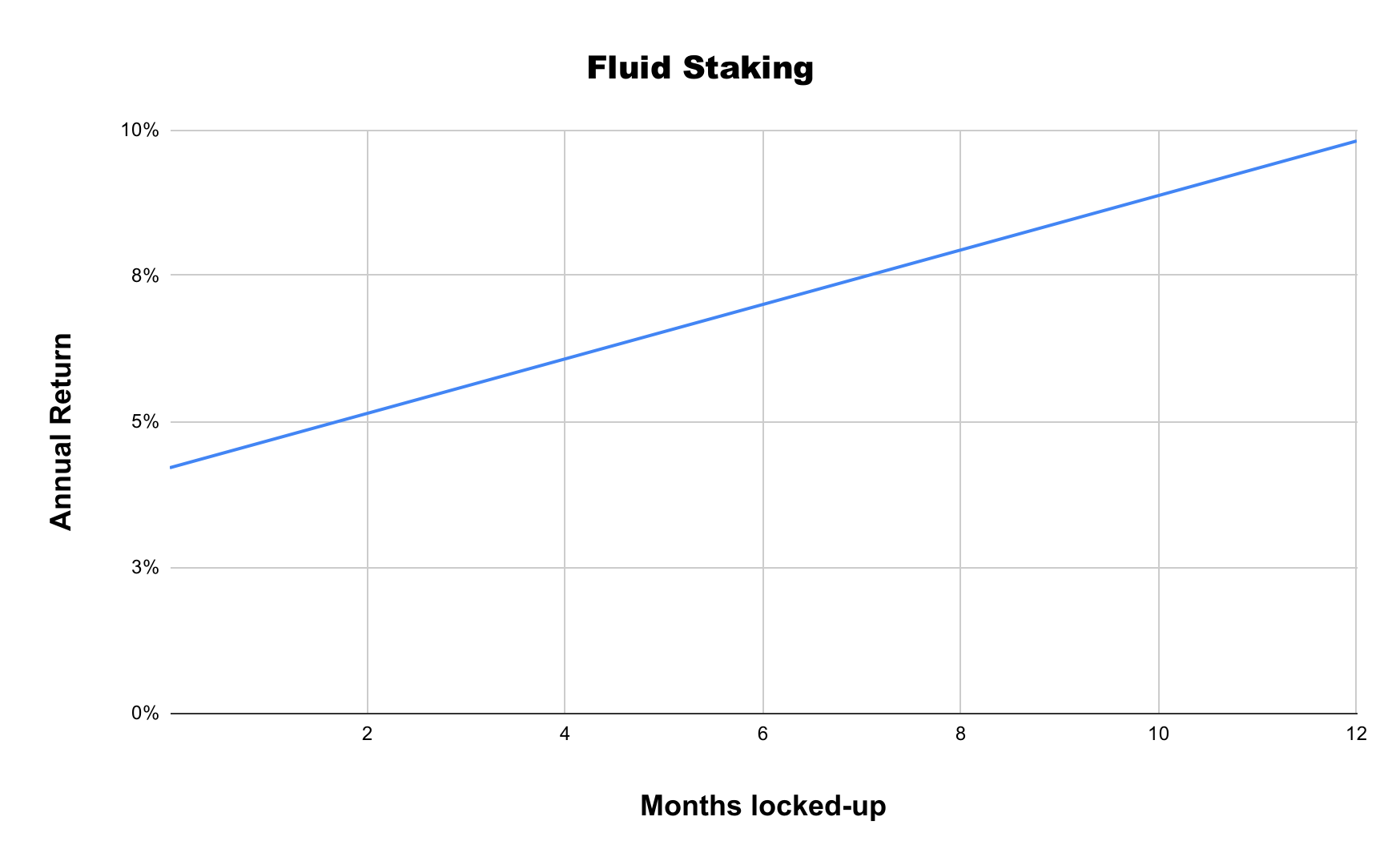

Fluid staking: You can opt to 'stake-as-you-go' for a lower annual return or lock your tokens up for any period up to 12 months for a higher annual return. Whether you choose to lock your tokens up or not, you will be able to claim and withdraw the rewards as they become available after a few epochs. Rewards will not be subject to the same lock as the principal stake, so you will be able to compound your returns regardless of your lock-up period.Unstaking will be subject to the usual 7-day unbonding period to guarantee network security.

If you choose to break your lock and unstake early, then you would be subject to a penalty: you will earn half of the base (stake-as-you-go) annualized rate for the period you've staked.

However, as the SFC releases rewards as they're accrued (at a higher 'locked-up' rate), the penalty will be against your initial stake to compensate.

It's important to note that it will not be possible to lose FTM from unstaking early. The SFC would only penalize against already withdrawn rewards.

If you commit to a longer lock-up, you will earn more annualized rewards per FTM, as shown by the above graph that shows how rewards would change with lock-up duration assuming 60% total staked.

As in the current model, rewards will scale downwards as staking participation increases.

The Foundation's position

We implemented Model 1 at the launch of the Opera mainnet to encourage early participation, handsomely rewarding those who actively contributed to the network's security. The model has been a considerable success in that regard, with over 50% of FTM staked after just five months – one of the fastest staked projects with a pre-circulating supply.

Now that we've achieved a high level of staker participation to secure the network, other objectives come to the forefront. The basis of the question we asked ourselves was this:

Can we propose a new staking model that's more sustainable (lower inflation, a longer reward runway, etc.) while allowing our most committed network participants to continue earning rewards that significantly outperform inflation of the network?

We believe the new model does precisely this. While the nominal returns are lower than the status quo, if you calculate the real returns after inflation, then those that lock their tokens for a significant period are still able to earn a considerable rate.

We're excited to hear the community's thoughts and suggestions during tomorrow's AMA; click this link for direct access to our Discord server.