Fantom Finance, what's coming

DeFi: trading and lending reimagined

DeFi is the hottest thing in the crypto space right now. It's the first killer app for blockchain, and it shows.

Even if it's arguable that Bitcoin is DeFi by definition, DeFi has assumed a more specific meaning. Users can now innovatively access several financial tools: they can use the most creative ways to put that money to work with full control over their funds. DeFi is the purest and most automated definition of passive income. Many brilliant minds joined the DeFi game to leverage blockchain technology at its full potential.

Undeniably, Ethereum has a huge advantage over every other blockchain platform. It was the driving force behind the ICO boom of 2017, and as a result, there’s a large number of Ethereum-based assets. These assets are the catalyst of the DeFi boom that we’ve experienced in the past months.

ERC20 tokens are the fuel of this first wave of DeFi, and they represent the enormous AUM (assets under management) on Ethereum, part of which is locked in rising figures making up the TVL (total value locked). Users lock their assets to earn interest on them, or they use it as collateral for borrowing other assets without losing exposure to their original asset.

DeFi brought a more streamlined and direct user experience towards financial tools. Trading, lending, and borrowing have never been this seamless.

Swaps, next-generation trading

Uniswap showed the convenience of instant swaps. Trading is faster, more simple, and fun compared to traditional order book trading. All the orders are market orders; users either buy or sell at the current price or, if they want different rates, they'll have to wait until the market goes there. It’s not possible to place an order in the book, like centralized exchanges or other types of decentralized exchanges.

Not everything is rosy, though. Ethereum, where all the DeFi action is currently taking place, is experiencing an unprecedented amount of transactions. The consequences are slow transactions and very high fees: in the past few days, the average fee on Uniswap was around $10, with peaks of $30 and more. Transaction fees are independent of the amount traded, so users could end up paying more in fees than the amount they're trying to buy or sell.

Users can choose to pay lower transaction fees, but in that case, the confirmation time can extend to several minutes or even hours and days. When trading on Uniswap, that would most likely result in a failed transaction because the trade wouldn't be available after that much time. Even if the transaction fails, users still have to pay the fees.

It's crypto, it's fun, and some people are making money; that's enough to close an eye over these limitations. For now. However, the status quo isn’t sustainable or fair. In normal market conditions, why would a user pay 10-50x the fees to trade on Uniswap compared to a centralized exchange?

Fantom Finance. DeFi, but better

This is where Fantom comes into play. Fantom uses an aBFT consensus mechanism, called Lachesis, that allows for fast and cheap transactions. They cost a fraction of a cent and are confirmed in a couple of seconds. Unlike Ethereum, Fantom is designed for high throughput.

DeFi-as-a-service

While Ethereum has an advantage regarding assets under management – they’re built on Ethereum itself –, at Fantom, we aim to expand the DeFi space outside of the Ethereum ecosystem. We’re making DeFi accessible to those tokens and cryptocurrencies whose main focus is not DeFi, but they still want to have exposure to it. You can think of it as DeFi-as-a-Service.

We’re working on integrating Ethereum Classic’s ETC, Ontology’s ONT, OKEx’s OKB, and Tokoin’s TOKO; many others are in the pipeline.

Moreover, since Fantom Opera chain supports the Ethereum Virtual Machine (EVM), tokens integrated on Fantom could have indirect access to Ethereum and its whole DeFi ecosystem.

We’re headed towards a future of interconnected decentralized exchanges that share everything, from liquidity to orders, assets, and much more.

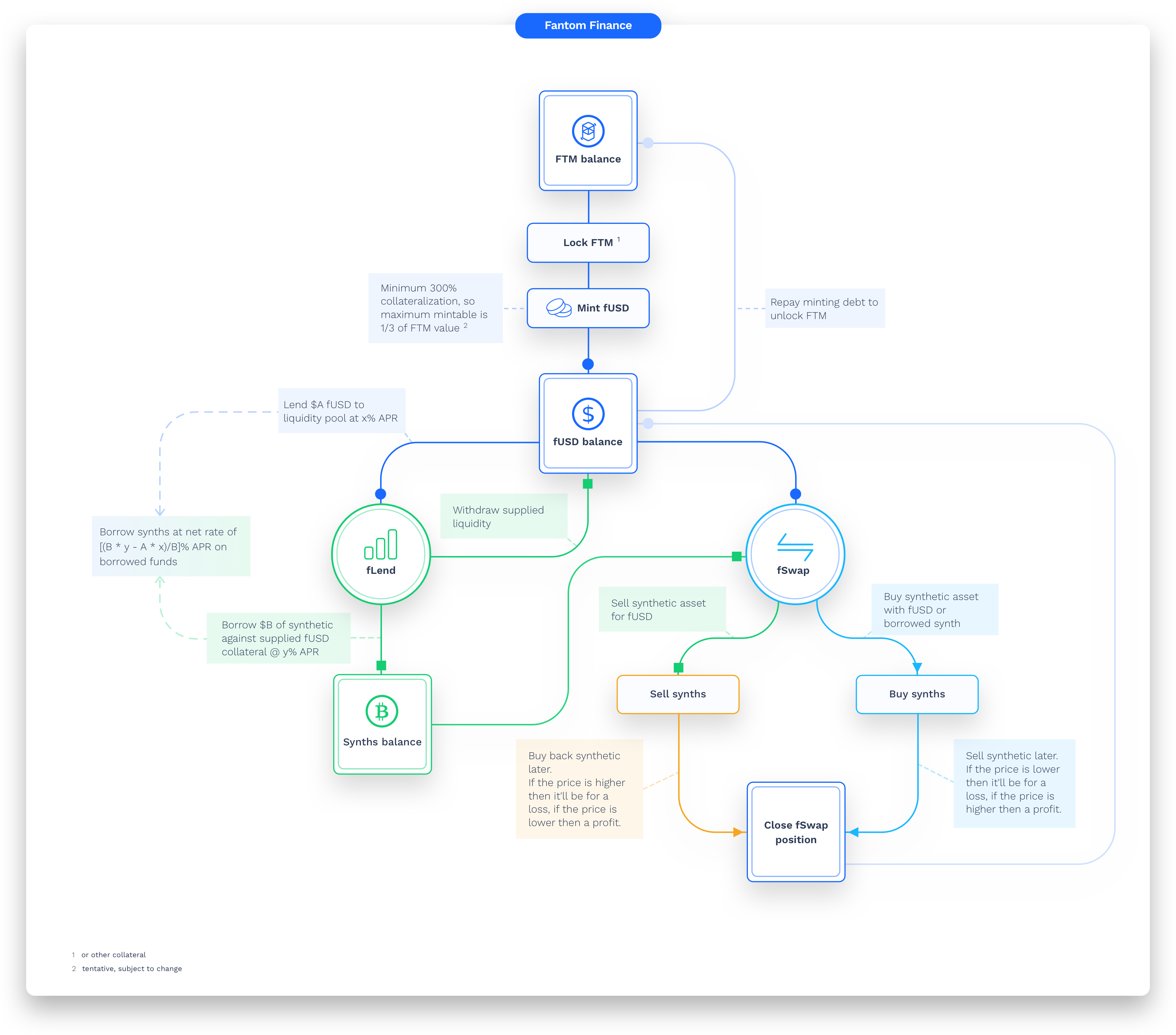

Fantom Finance explained

Initially, the Fantom DeFi suite will feature three components: fMint, fSwap, and fLend.

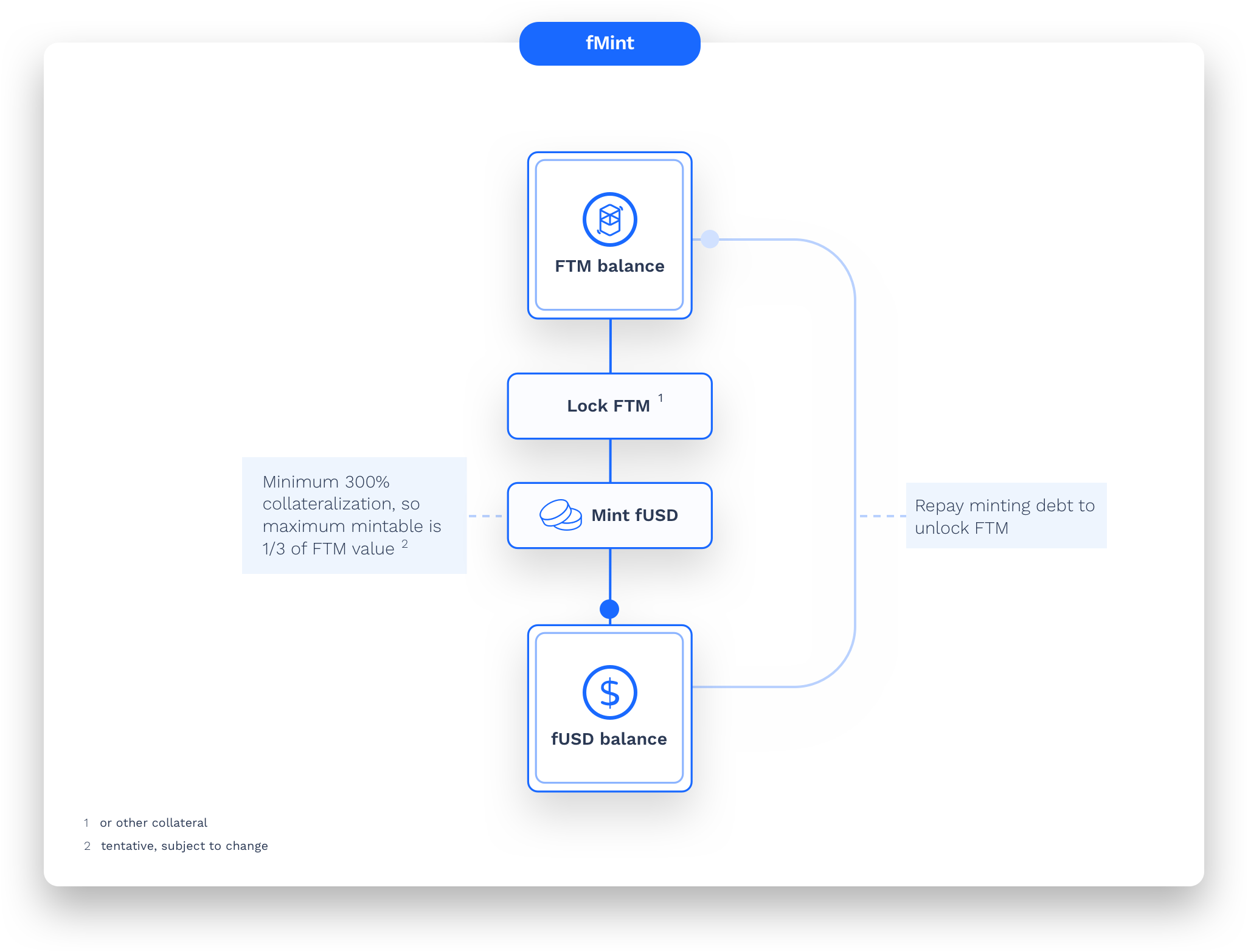

What is fMint?

fMint is the gateway to Fantom Finance. Users will be able to lock their FTM and mint fUSD, a collateralized stablecoin on Fantom pegged to the US Dollar. For example, if Alice has $600 worth of FTM, she can mint up to 200 fUSD (at a tentative 300% collateralization ratio, subject to change).She can then use fUSD on fSwap and fLend, and eventually repay the minted fUSD to unlock her FTM.

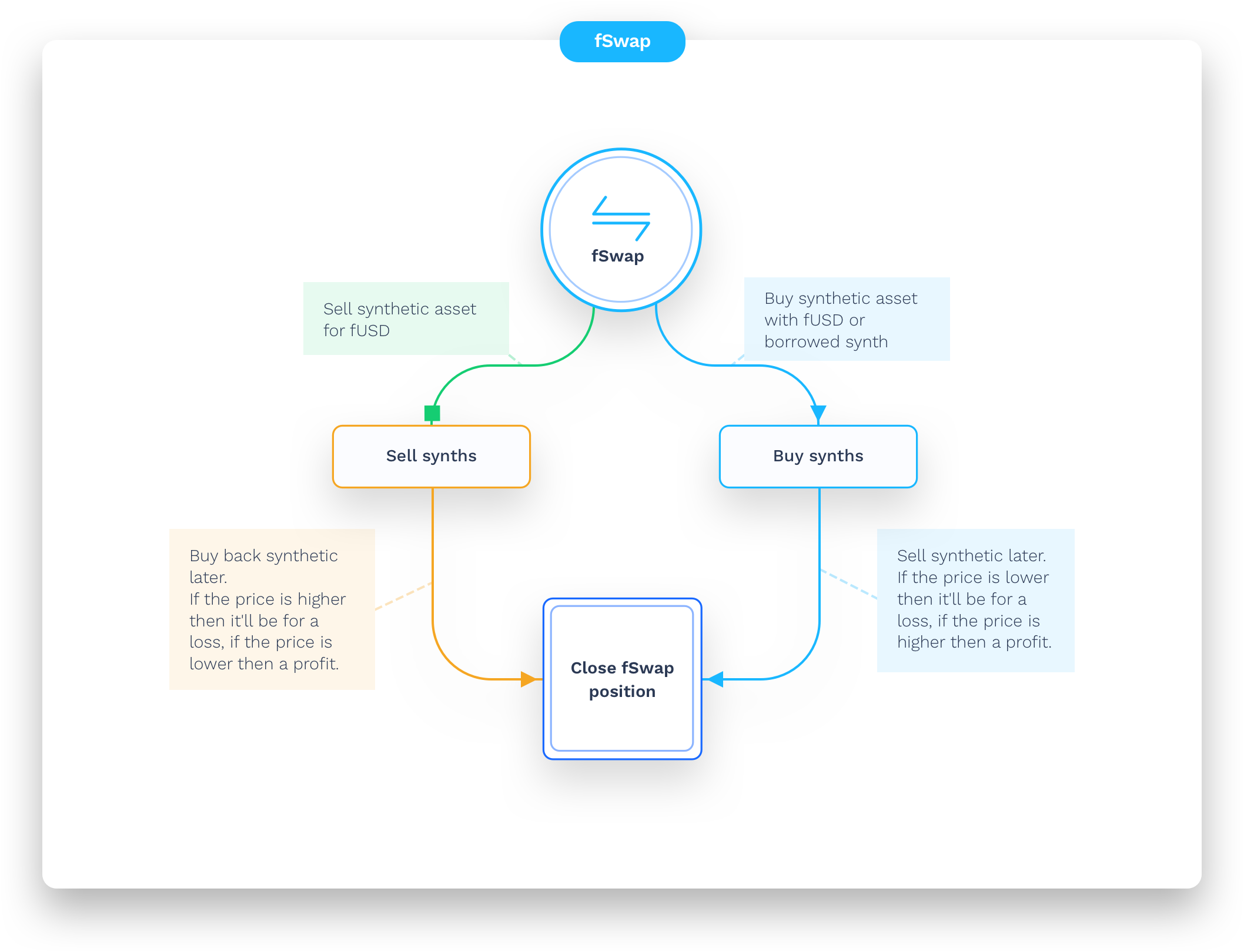

What is fSwap?

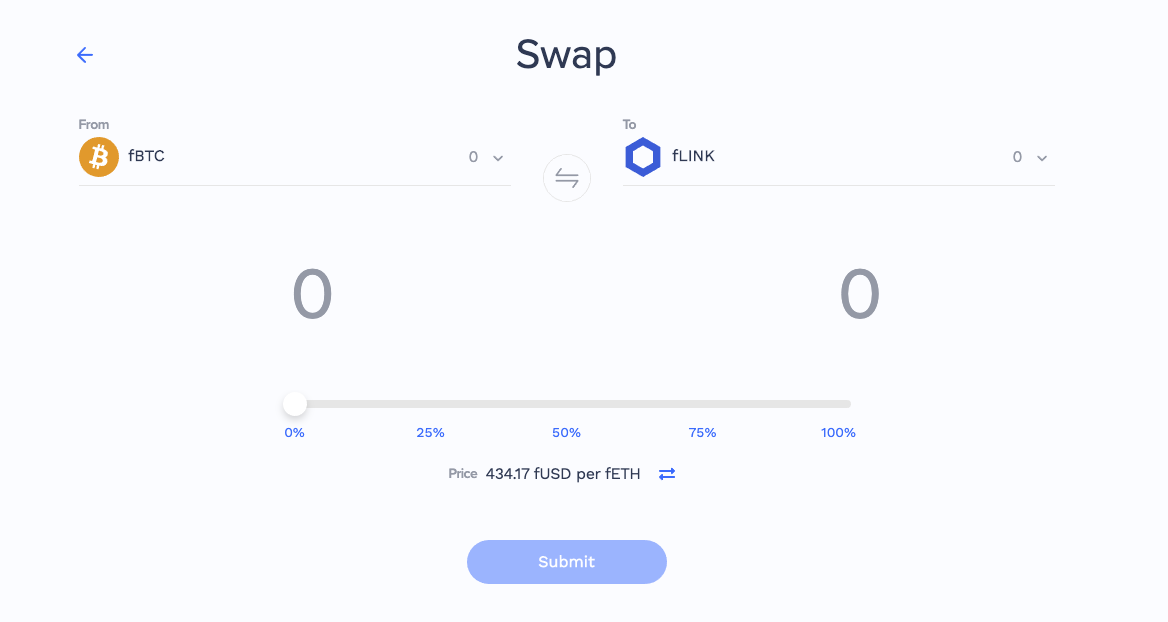

We adopted a similar approach to Uniswap, and we created fSwap (previously known as fTrade). Unlike Uniswap, where users trade real tokens, on fSwap users will trade synthetic tokens.

Synthetic tokens, or synths in short, are tokens that track the price of the token they represent. The rate is always accurate and provided by decentralized oracles such as Chainlink and Band Protocol. Moreover, compared to real coins and tokens, synths don't have liquidity and slippage issues.

Initially, we'll provide 176 synths based on the most traded cryptocurrencies. We're planning to expand to more synths in the future, not necessarily based only on crypto assets.

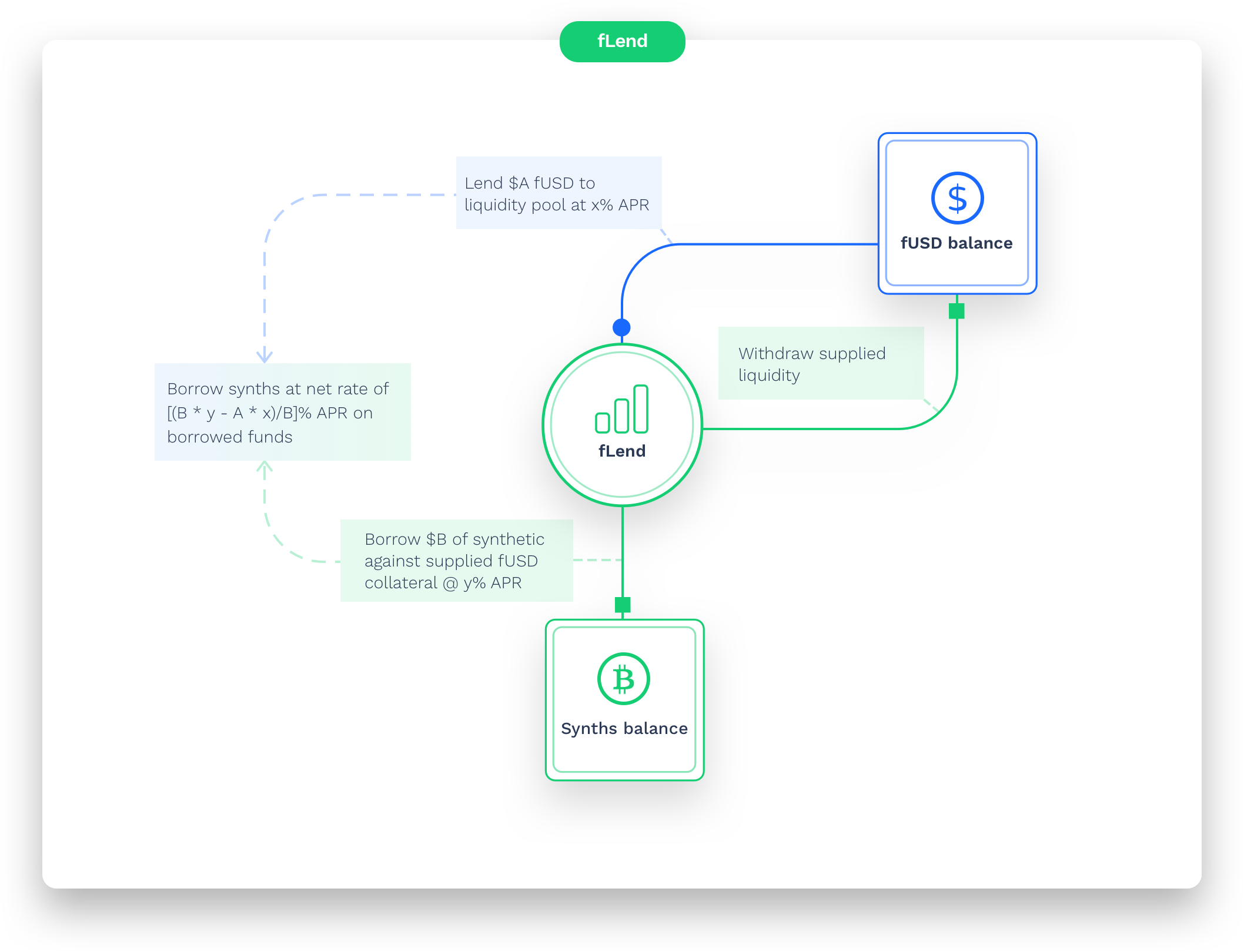

fLend – decentralized lending and borrowing

Besides the faster user experience of swaps, DeFi users can also trade without losing their original asset exposure. Unlike centralized exchanges, where users are forced to sell their tokens to trade other pairs, DeFi allows them to retain the positions and use their tokens as a collateral.

On Fantom, we created fLend.

There are two main components on fLend: lending and borrowing.

Users can lend their fUSD and synthetic tokens to the liquidity pool. By doing so, they earn passive income and can start coming up with their own best strategies to find the best way to put their money at work.

For example, if they think that ETH will go up in price in the future, they can mint fUSD, trade it for fETH – the synthetic version of ETH on Fantom – and then lend fETH to the liquidity pool. That way, not only will they benefit from the appreciation of fETH, but will also earn interest on the synth.

Conversely, users can use their collateral to borrow synthetic tokens, paying interest on the debt. They can then trade them in fSwap, or lend them in fLend.

For example, users can borrow an asset and go short on that particular asset; similarly to buying a synth to go long without losing exposure to FTM or another collateral supported by Fantom, they can hedge their position with a short. They don’t have to sell FTM, but they can preserve their capital in the event of a market downturn and a subsequent bear market.

We won't hide that we're genuinely excited about Fantom Finance. It's been in the works for quite some time now, and this is just the beginning. We're planning to refine the user experience further to make it as easy as possible for everyone to use and expand the suite with other tools. We're already throwing some ideas around. Stay tuned for more!