An introduction to Fantom CBDC

News of rapid growth on the Fantom public chain and increased TVL on Fantom DeFi protocols has captured the headlines of late. But the enterprise-side has also made significant strides.

One area of ongoing activity is in the research and development of Central Bank Digital Currency (CBDC) solutions.

Read on for a brief overview of the flexible and powerful solution the team has been working on.

What is CBDC?

In simple terms, CBDC is a Central Bank-issued and controlled digital currency that functions like regular banknotes. CBDCs can be used by individuals or small businesses to pay each other – retail CBDC – or by financial institutions interacting to settle interbank transfers or securities transactions – wholesale CBDC.

Interest in CBDC has skyrocketed over the past years. The Bank of International Settlements (BIS) reported in Jan 2021 that it had surveyed 65 different central banks which together, represent 91% of global economic output. Fifty-six of the banks surveyed indicated that they were either researching or moving towards practical development and testing of CBDCs.

Major international organizations have also set up working groups focused on digital currencies. Fantom, in fact, presented its CBDC solutions in March 2021 to the Stanford Digital Currency Global Initiative and connected stakeholders.

Fantom CBDC

An effective CBDC solution needs to be extremely fast, capable of handling high transaction volume, cheap, and bank-level secure. To its core, Fantom is all of these things.

Depending on the client preferences, Fantom can route transactions through the public chain or a dedicated network of nodes with high performance and security.

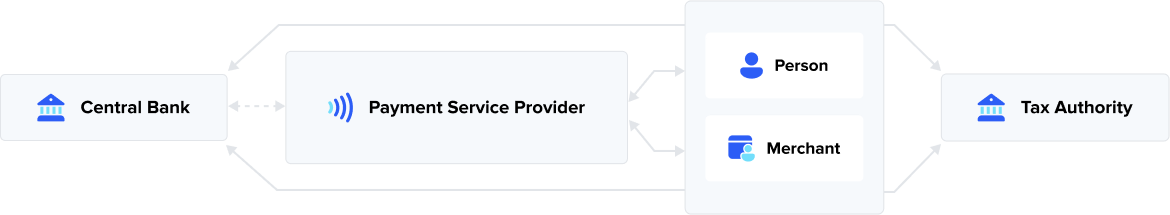

The Fantom CBDC model adapts an approach validated by the Bank of England. It is called hybrid because it combines “retail” and “wholesale” CBDC. Commercial banks establish direct accounts with national central banks on the wholesale side of the Fantom CBDC solution.

On the retail side of the network, the same commercial banks serve as an intermediary layer, responsible for on-boarding and communicating with customers and conveying payment messages to other banks and the Central Bank itself.

One notable advantage of this model is that it avoids the disintermediation of commercial banks, which is a frequent sticking point for CBDC critics.

Solutions that opt for consumer accounts held directly at the central bank completely bypass banks and marginalize the essential consumer services that they offer. The Fantom hybrid model preserves in-place and needed banking infrastructures.

Why do we need CBDC?

A primary driver for interest in CBDCs has been the rise of stablecoins and alternative digital payment platforms.

Governments worldwide are keen to offer digital currencies with the same advantages as crypto currencies but with consumer protections and policies to ensure financial stability.

But beyond this, and in terms of Fantom CBDC specifically, there are many other benefits:

For Retail CBDC (i.e., individuals and small businesses)

- Fantom CBDC can be accessed via mobile wallets, allowing for effortless digital and contactless payments.

- Mobile wallet functionality also allows banks to extend beneficial services to the unbanked and promote financial inclusion.

- Lower transaction costs and the elimination of intermediaries allow banks to offer needed microfinance services (like microloans or microcredit) that have been, to date, too expensive to implement.

- Automatic tax and VAT policies built into the Fantom solution alleviate administrative burdens of merchants.

- Payments are settled immediately, and services are available 24/7.

Wholesale Level (i.e., banks and large enterprises)

- Interbank payments finalize quickly as settlements and clearance are collapsed into one process.

- Easy traceability of every issued CBDC unit supports Anti-money Laundering (AML) and Combating the Financing of Terrorism (CFT) initiatives.

- Government administrations can easily and rapidly distribute helicopter or stimulus payments, saving time and money versus current methods.

- The design of the Fantom system that includes digital ID limits currency substitution (the use of foreign currencies over national currency) and promotes economic sovereignty while protecting privacy.

What’s next?

Fantom has finalized an implementation strategy that is being brought to central banks globally. As Barek Sekandari (COO) mentioned in a recent AMA, a lot is going on behind the scenes. Keep up with the latest news on Twitter and the Fantom blog.