Introducing fMint

With fMint, you can mint fUSD by locking up FTM, or synthetic assets by locking fUSD. fUSD is a stablecoin on Fantom, and it's the gateway to Fantom DeFi.

What is minting?

Minting is the process of locking collateral as proof you can pay back fUSD. For background, let’s start with the example of a home equity loan that many people will be familiar with: I go to the bank and ask for a $10,000 loan. The bank wants to be sure that I'll repay the $10,000, so they use my house, valued at $100,000, as collateral. The loan amount is only 10% of the collateral value, so the bank is confident that they'll recover the $10,000 - either I'll pay it back, or they'll be able to sell my house and get at least $10,000 for it.To be clear: I still own my house, I have not sold any part of my house to the bank. If the price of my house goes up, I still only owe $10,000 (plus some interest), the bank’s entitlement does not increase if the value of my house increases. Once I repay the fixed $10,000 loan, the house is 100% mine, whether it's now worth $50,000 or $2 million.If the value of my house decreases dramatically and I can't repay the $10,000 loan, the bank may become worried about recovering what they are owed. They can then take possession of my house and sell it on my behalf. This gives the bank peace of mind that they can always recover the loan amount. If they manage to sell the house for $20,000, $10,000 (plus some interest) will go towards paying my debt, and the bank will pass the remainder of the proceeds on to me.

How does this relate to fMint?

In the case of fMint, you lock up some collateral in a smart contract (FTM, for example), and can then mint fUSD against it.

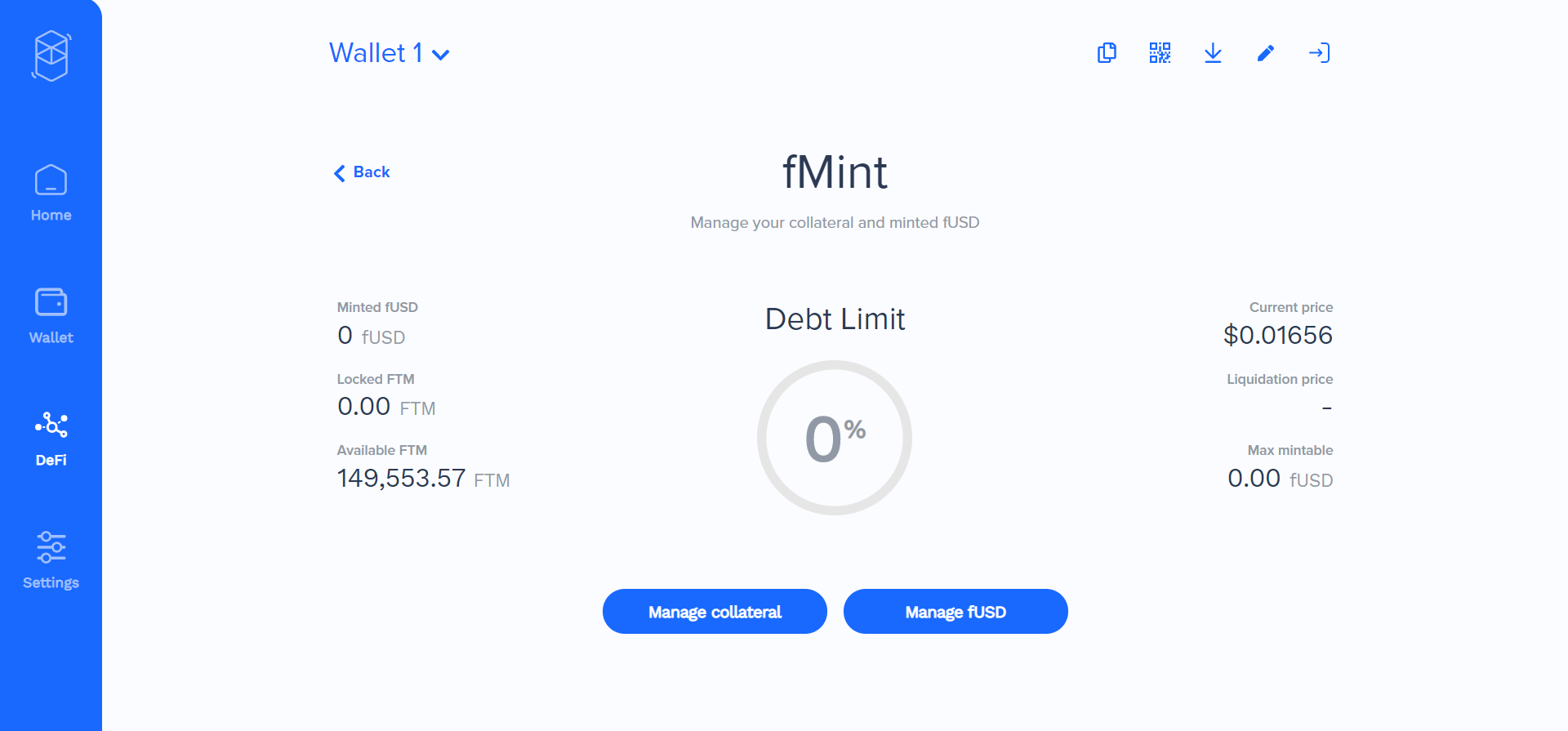

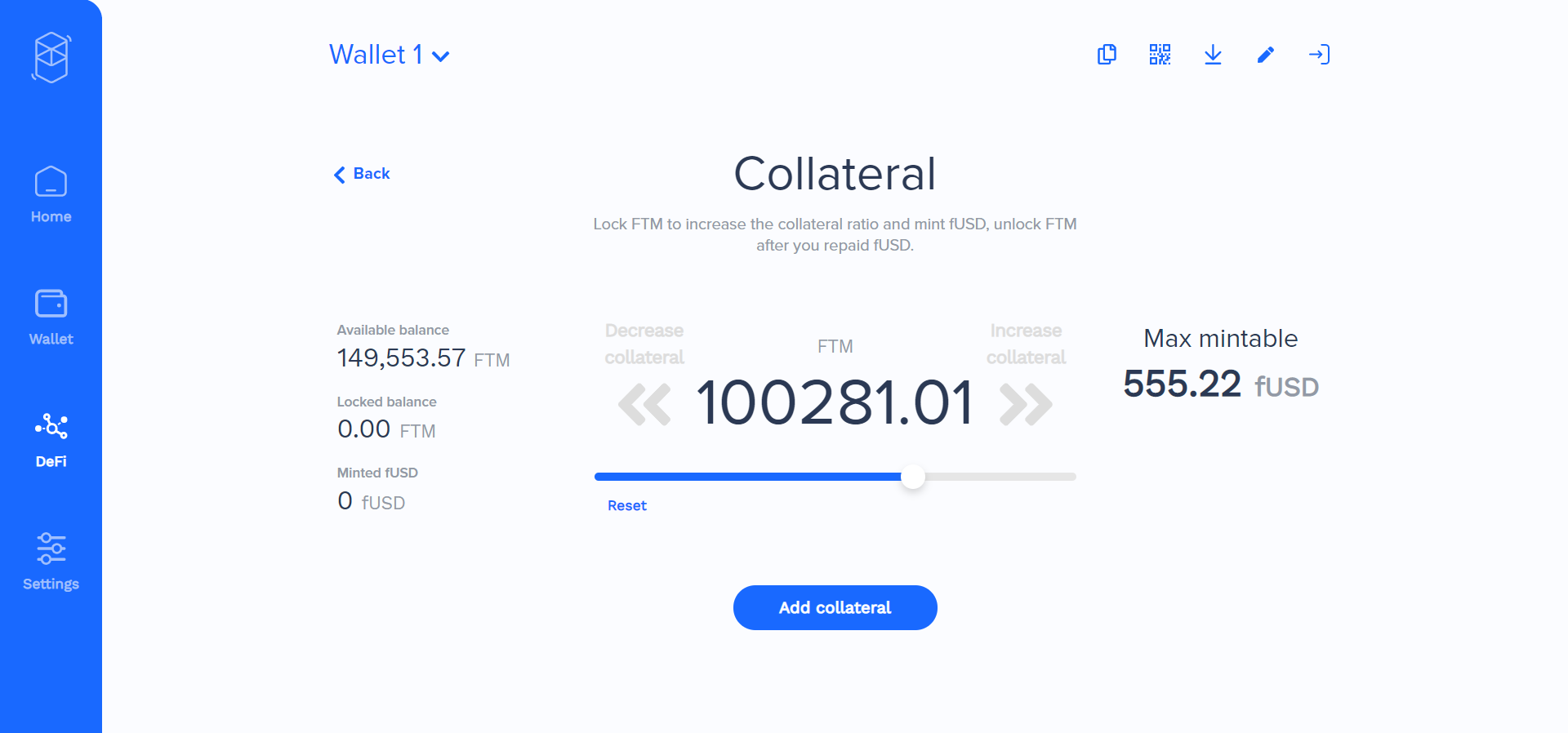

Let’s start by locking some FTM with ‘Manage Collateral’.

I can move the slider right if I want to add more collateral, and left if I want to unlock collateral. As I do this, my max. mintable fUSD changes. I can also adjust my position later; if my collateral value drops then I'll lock more FTM to reduce my risk of liquidation.

The max. mintable value is set to 1/3 of my locked collateral (this ratio is subject to change). This limit gives people a safety cushion to prevent liquidation in case their collateral value drops. It will be set by governance in future.

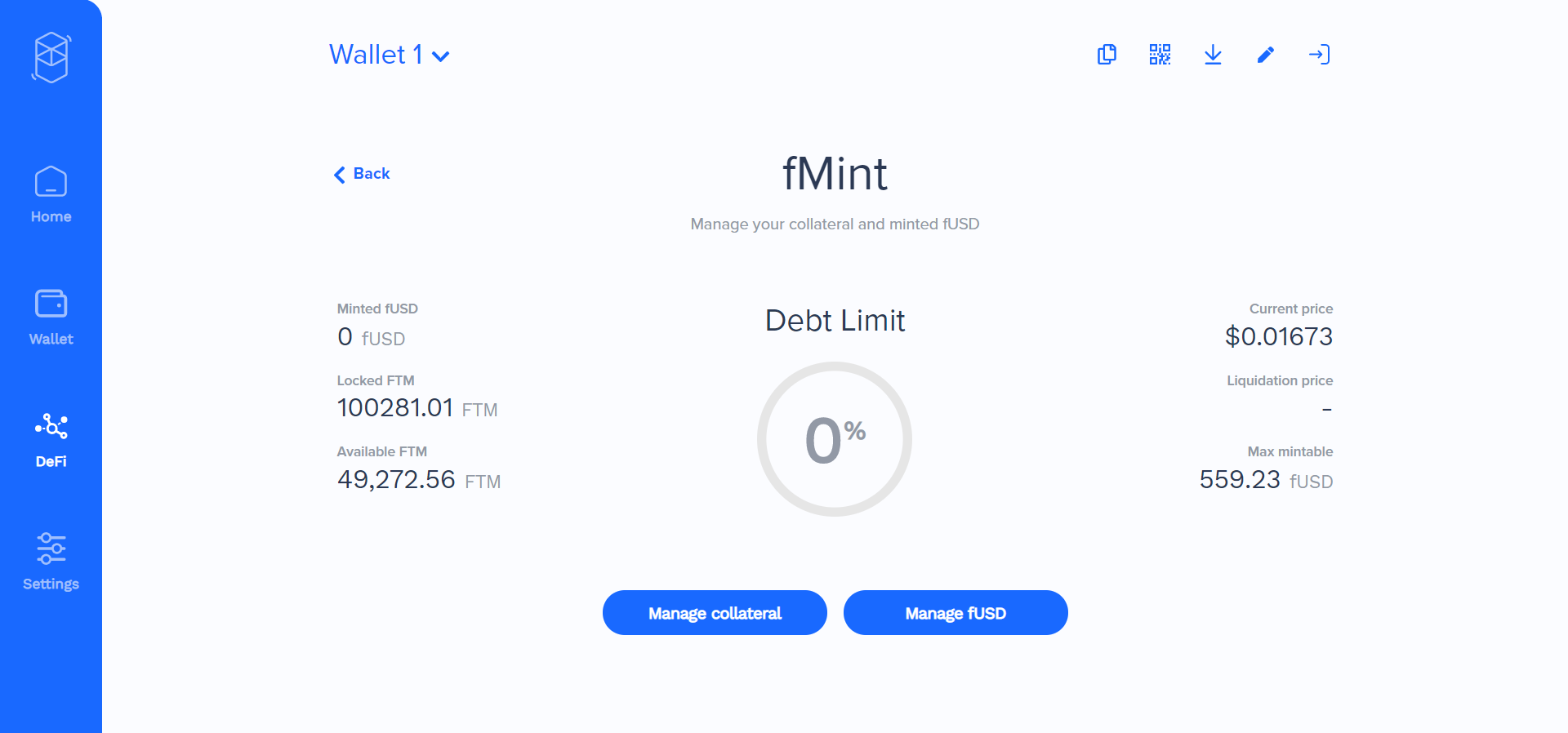

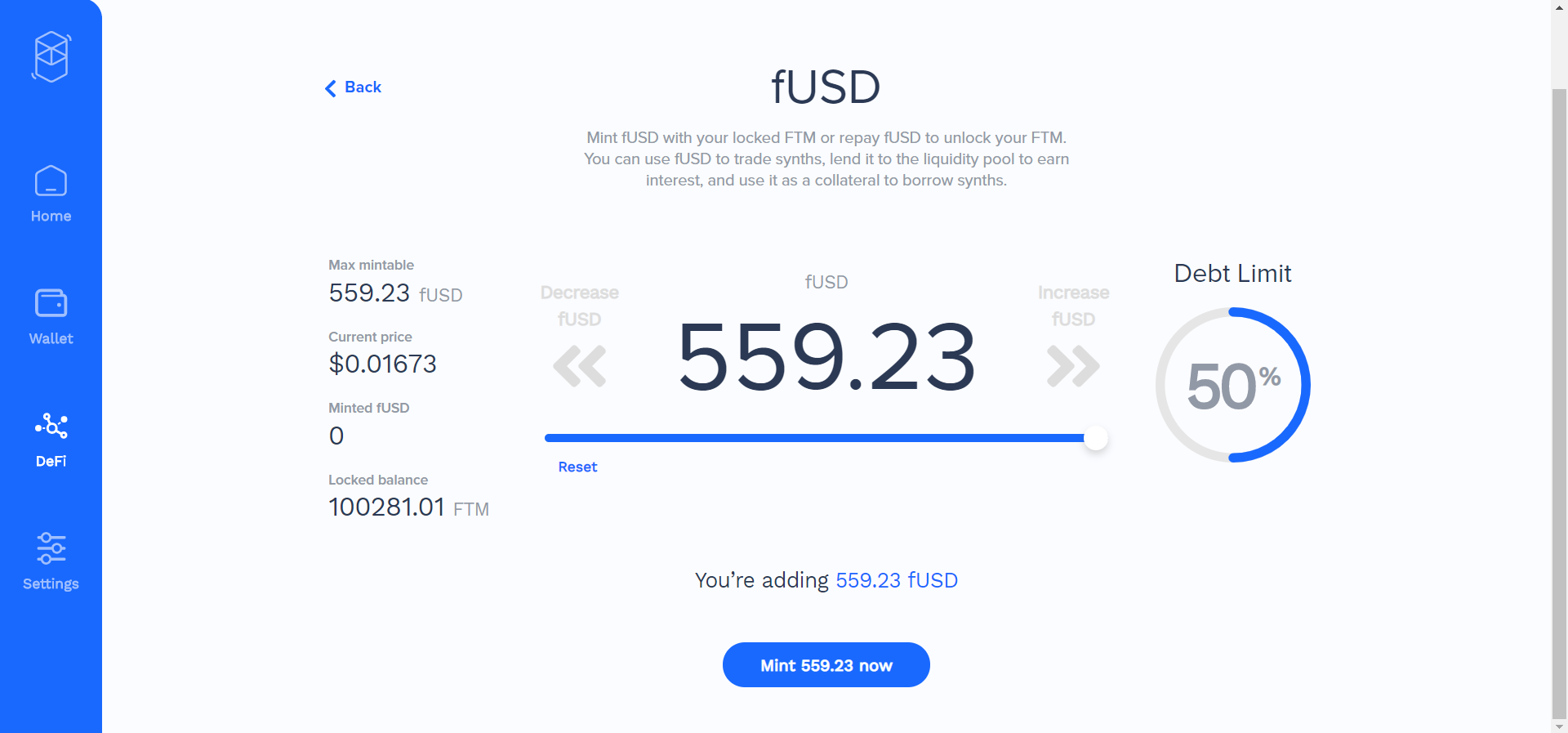

I've now locked my collateral, and I can mint fUSD with 'Manage fUSD'.

When minting fUSD, you'll be able to mint up to the max. mintable as described above. You'll also notice a debt limit on the right-hand side. This shows you how close you are to liquidation. If your debt reaches 100% of the limit, your collateral will be liquidated and you'll be left with your fUSD position plus any collateral left after the liquidation process.

Liquidation (a 100% debt limit) occurs when your debt reaches 2/3 of your collateral value (66.7%), or double your max. mintable value. We've standardized everything so all you need to watch to avoid liquidation is your debt limit. Keep it under 100% to avoid liquidation. We recommend an even more conservative approach, 50-75%. Remember, to decrease your debt limit you have two options: repay fUSD to reduce your debt, or lock more collateral.

How do I unlock my FTM?

Just use the reverse process: Within 'Manage fUSD', move the slider to the left to repay your fUSD debt. Then, within 'Manage Collateral', you can move the slider to the left to unlock your collateral.